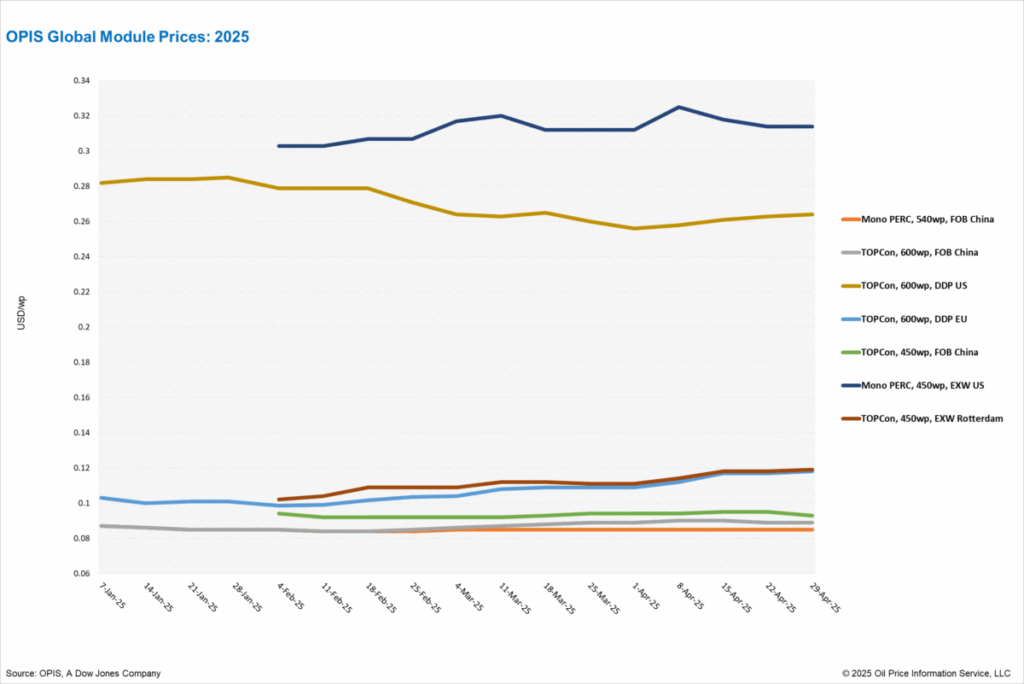

In a new weekly update for PV -MagazineOpis, a Dow Jones company, reports that Topcon modules from China remained stable between $ 0.085-0.090/W. It also reveals that the prices of Europe for Topcon modules of more than 450 W rose by 0.96%, assessed at € 0.105/W.

China: The Chinese Modulemarker (CMM), the OPIS benchmark assessment for Topcon modules from China, kept stable at $ 0.089/W free-on-board (FOB) China, with indications between $ 0.085-0.090/w. FOB China Mono Perc module prices were stable at $ 0.085/W with indications between $ 0.082- 0.088/W.

In the forward market, charging of Q2 2025 continued to be flat at $ 0.089/W, while the prices of Q3 2025 were rated at $ 0.086/W. The prices for Q4 2025 fell 1.16% on the week to $ 0.085/W, while Q1 and Q2 2026 softens charging prices with 1.18% to $ 0.084/W, with prices ranging between $ 0.080-090/W.

FOB China Topcon Panels of less than 450 W For spot load, 2.11% fell to $ 0.093/W, with lower price indications between $ 0.090- 0.098/Wp.

The demand from distributed PV projects in China is said to have decreased considerably as the momentum of the 430 policy-driven installation stressers explain, with both project developers and channel partners who experience a reduced order of order that the market conditions can continue to mitigate between late Q2 and Q3.

Although China added nearly 60 GW of photovoltaic installations in the first quarter-an increase of approximately 30.5% on an annual basis and positive support for module manufacturer-warners in industry that the Chinese module producers will remain for increasing challenges. These include the rise of domestic production possibilities in important export markets, continuous patent disputes at Chinese companies that can limit international market access and a delay in export growth as the overseas markets are always saturated.

Europe: DDP Europe prices for topcon modules of more than 600 W rose by 0.97% a week to € 0.104/W, with market indications ranging from € 0.096/W to € 0.112/W for Tier-1 panels.

EXW Europe prices for topcon modules of more than 450 W also rose by 0.96%, rated at € 0.105/W, with reported indications ranging from € 0.097/W to € 0.115/W for Tier-1 panels.

From a broader geopolitical perspective, American rates on Chinese sun products still have to influence the European market. Although China can reduce shipments that are originally intended for the US, analysts are of the opinion that the risk of a new price war remains low, because the margins in Europe have already been compressed considerably.

US: The bargain price for Topcon ≥600WP DDP US was assessed this week at $ 0.264/W, an increase of 0.38% compared to last week, while the spot price for mono perc modules of more than 450 “EXW fell by 1.59% to $ 0.309/W.

Looks ahead, Opis maintains his assessment for the first quarter of 2026 at $ 0.276/W for Topcon modules and $ 0.266/W for monocrystalline perc modules. The forward curve remains unchanged compared to the last week, with sources that noticed a general restraint from both buyers and sellers to send contracts.

Since the market adapts to the implementation of the universal rate of 10%, sources indicated a lack of substantial stock activity by customers prior to the 90-day mutual rate window, which reflects a modest market. A large developer noted that although a price increase of one to two cents is possible, there must not yet be a substantial market reaction of suppliers in response to the rate.

In the meantime, some suppliers have reportedly shifted their focus on the communication of the customer to the traceability of the supply chain and the adjustments made in the light of the current trading tensions.

Market sources also indicated the potential for short-lived price increases after the final determination of the US Department of Trade in anti-dumping and countervailing tasks research into solar cells and modules from four Southeast Asian countries. Some suppliers can take advantage of media attention on the highest tariff rates to justify temporary price adjustments, added sources.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content