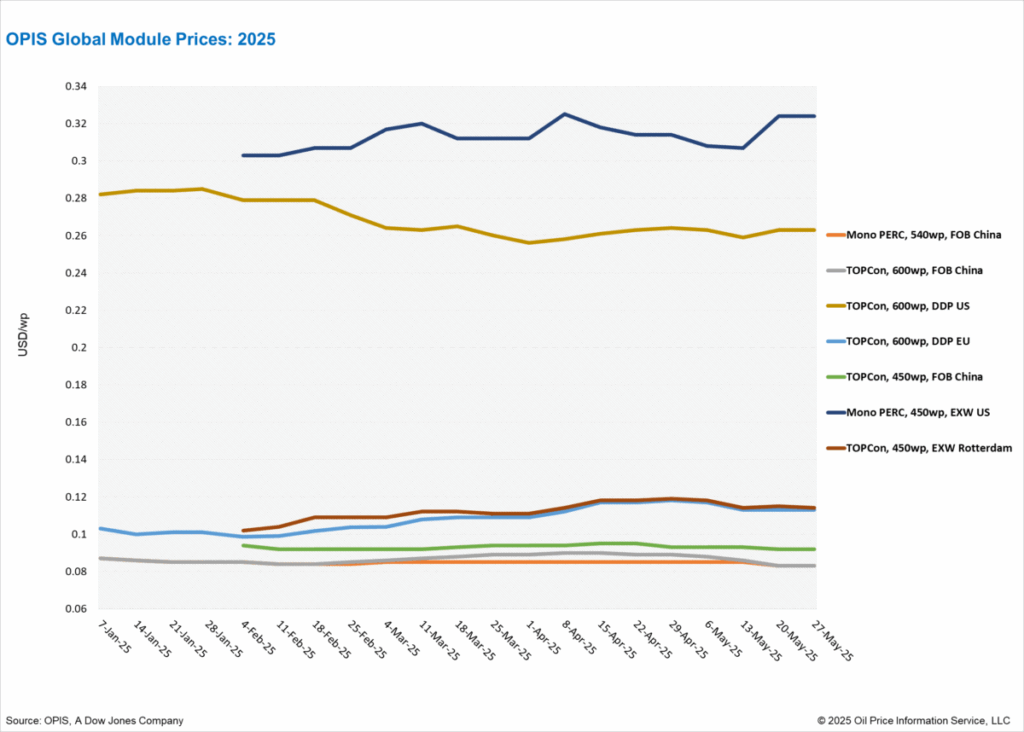

In a new weekly update for PV -MagazineOpis, a Dow Jones company, reports that Topcon modules from China have kept stable at $ 0.083/W. In the meantime, the bargain price for American Topcon modules of more than 600 W this week was assessed at $ 0.263/W.

China: The Chinese Modulemarker (CMM), the OPIS-BENCHARK CHANCE FOR TOPcon modules from China, kept stable at $ 0.083/W free-on-board (FOB) China, with indications between $ 0.079-0.087/W. FOB China Mono Perc module prices retained at $ 0.083/W with indications between $ 0.080- 0.088/W.

In the forward market, charging loading loads for Q3 2025 were assessed at $ 0.083/W, while the prices of Q4 2025 were slightly lower at $ 0.082/W. Before 2026, the charging prices of Q1 and Q2 were assessed at $ 0.081/W and $ 0.080/W respectively, with price ranges for both quarters between $ 0.078 and $ 0.084/W.

FOB China Topcon ≤450 W modules for spot load were stable at $ 0.092/W, with price indications between $ 0.090-0.098/W.

FOB China Topcon Module prices remained stable this week after three consecutive weeks of falls, according to OPIS data. Since the beginning of May, prices have fallen by 5.68%. The monthly average for May was assessed at $ 0.085/W, against $ 0.087/W in April. Sentiment With regard to the market front views, Beerarish remains, where participants in the industry warn that subdued the domestic installation -question in the coming months could exert further downward pressure on export prices.

According to data released by the National Energy Administration last week, China added 104.93 GW to new photovoltaic solar energy -capacity between January and April 2025 -at 74.6% of 60.1 GW for the same period in 2024. In April alone, 45.22 GW contributed to new installations.

Trade sources attributed the increase in policy -driven Rush before 430 and 531 deadlines, because developers hurried installations to complete projects before the new policy came into effect. Despite the strong start of the year, a top-five module manufacturer told OPIs that the market continues to struggle with oversupply and increased stock levels. Several sources in the industry noted that the question in early months of 2025 could lead to a delay in installation activity during the rest of the year.

US: The bargain price for Topcon ≥600 W DDP US was rated this week on $ 0.263/W, where loads from Southeast -Asia saw an average price of $ 0.256/W and load from India that saw an average price of $ 0.288/W. The bargain price for Mono Perc -modules ≤450 W Exw East Coast Warehouse (from distributors to installers) held at $ 0.324/W.

Looks ahead, OPIS maintains his assessment for the first quarter of 2026 on $ 0.276/W for DDP US Topcon ≥575 W -modules and $ 0.266/W for DDP US Mono Perc ≥540 W modules. The forward curve for 2026 is unchanged week after week, with sources that are hesitation about through -weather deals of both buyers and sellers.

The US International Trade Commission (ITC) made its final statement last week in the research into antidumping and countervailing tasks (AD/CVD) into solar manufacturers in four Southeast Asian countries, which reforms the rates that the worldwide Supply Chain have reformed in the past year.

Insiders in the industry expect that a new probe expect suppliers in Laos and Indonesia – recent production hubs – while lawyers for the same have confirmed this as a likely next step.

A project developer noted that the potential research can exclude LAOS and Indonesia as sourcing options for his company. Instead, the developer turns to American assemblers and actively strives for master delivery agreements with top -indian manufacturers, referring to the stability of avoiding tariff exposure.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content