Mercom Capital Group says total corporate solar financing, global venture capital financing, public market financing and PV system mergers and acquisitions all fell year over year in the first quarter of 2024. The sector is still struggling with high interest rates, says Wood Mackenzie. disproportionately affects renewable energy projects.

The global solar industry is experiencing “peak uncertainty and a challenging investment environment,” says Raj Prabhu, CEO of Mercom Capital Group, in the consultancy firm’s new advisory report. report on financing and mergers and acquisitions (M&A) in the first quarter of 2024.

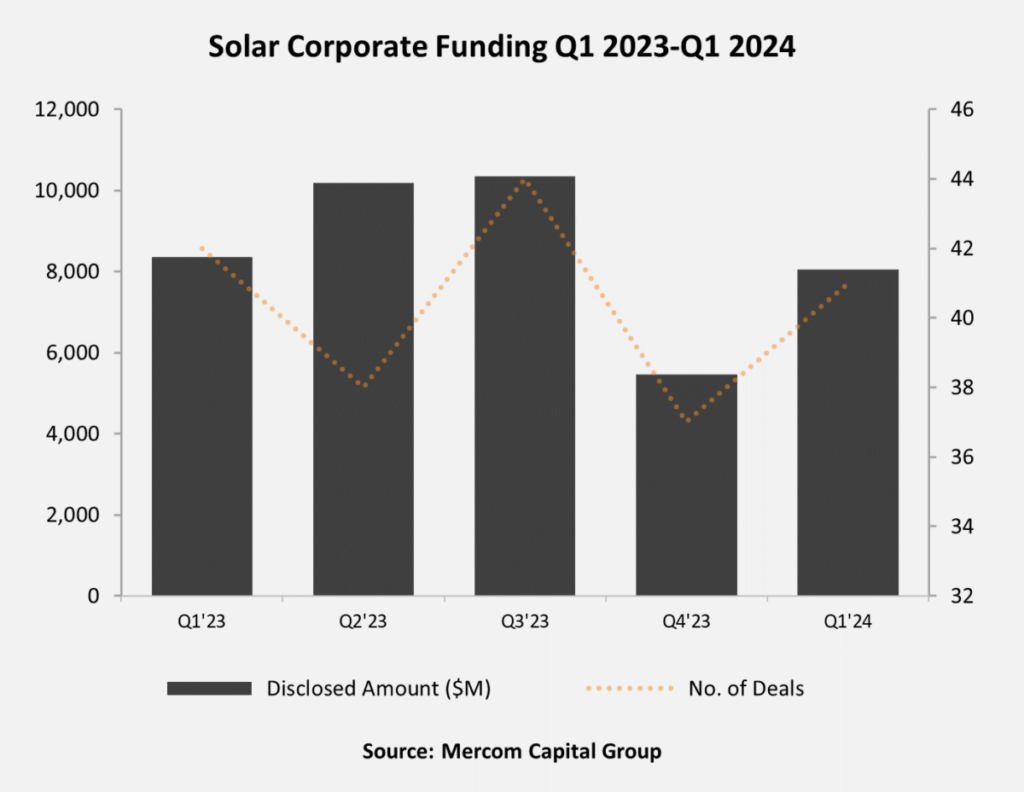

Mercom said total corporate financing in the solar sector reached $8.1 billion in the first three months of the year. The figure includes 41 deals, which represents a decline of 4% year-on-year. However, the figure is a 47% quarter-on-quarter increase from the $5.5 billion raised in Q4 2023.

Elsewhere, global venture capital funding in the solar sector reached $406 million across 13 deals in the first quarter of 2024, down 81% year-on-year. Public market funding across six deals reached $1.4 billion in the first three months of 2024, down 39% year-over-year. According to Mercom, debt financing increased 59% year-over-year across 22 deals.

“The solar sector is experiencing maximum uncertainty and a challenging investment environment,” said Prabhu. “The industry is grappling with multiple hurdles, including the likelihood of prolonged high interest rates, higher labor and construction costs due to inflation, and supply chain issues, coupled with trade disputes and tariffs.”

Mercom recorded a total of 21 solar mergers and acquisitions in the first quarter, unchanged from the fourth quarter of 2023, but down from the 27 solar mergers and acquisitions recorded in the first quarter of 2023.

“While a crash in Chinese module prices has boosted demand, it has made investment in manufacturing projects unattractive even when incentives were in place. Venture capital investments declined and M&A activity remains subdued,” Prabhu said. “Given current market conditions, it would not be surprising if the recovery is further delayed in combination with interest rate cuts.”

Meanwhile, Wood Mackenzie said in a separate report that if high interest rates persist, the transition to a net zero global economy will be “even more difficult and expensive”.

The consultancy firm’s latest report states:Conflicts of interest: the costs of investing in the energy transition in an era of high interest rates‘, it said the higher cost of borrowing negatively impacts renewables and emerging technologies compared to the oil and gas and metals and mining sectors, putting future renewable energy projects at risk.

“Interest rates, which have risen sharply over the past two years, may not fall as far or as quickly as markets expect,” said Peter Martin, head of economics at Wood Mackenzie. “These higher capital costs have profound implications for the energy and natural resources industries, particularly the cost and pace of the transition to low-carbon technologies.”

WoodMac said that in the United States, a 2% increase in the risk-free rate could push up the levelized cost of electricity (LCOE) for renewables by as much as 20%. The comparative increase in LCOE for a combined cycle gas turbine plant is 11%.

The research firm said solar and wind energy have an economic advantage over hydrocarbon generation sources, but higher interest rates are eroding this.

“Although energy and renewable energy companies have higher gearing, they compare favorably with other comparable groups in terms of debt burdens. But this is exactly what makes them more sensitive to interest rates,” said Martin. “Mechanisms to reduce price and offtake risk enable energy and renewable energy companies to obtain debt more cheaply than the relatively risky oil and gas and metals and mining sectors. The recent interest rate increase therefore has a greater proportionate impact on the cost of their debt.”

pv magazine print edition

The April edition of pv magazine considers a $9 billion subsidy package for rooftop solar in India, examines energy community moves in the US and Italy – as well as the decline in renewables in Australia – and extends into Egypt, Central Asia and the Middle East. All that plus a special section previewing this year’s smarter E Europe energy exhibition.

WoodMac said policymakers should focus on strengthening carbon markets, maximizing subsidy efficiency and mobilizing green finance to offset headwinds, he added.

“The good news is that policymakers can take steps now to offset or at least ease the burden of higher interest rates,” Martin explains. “Policymakers must remove obstacles such as slow permitting and project approval and provide clear, consistent and sustainable incentives to support the introduction of low-carbon energy and emerging green technologies.”

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.