OFF-GRID solar investments fell by 30% in 2024, with hardest business and technology technology hardest, says Gogla. The Global Association for the off-grid solar energy industry adds that upscaling has attracted 77% of the invested almost $ 300 million, indicating a stronger commercial viability in adult players.

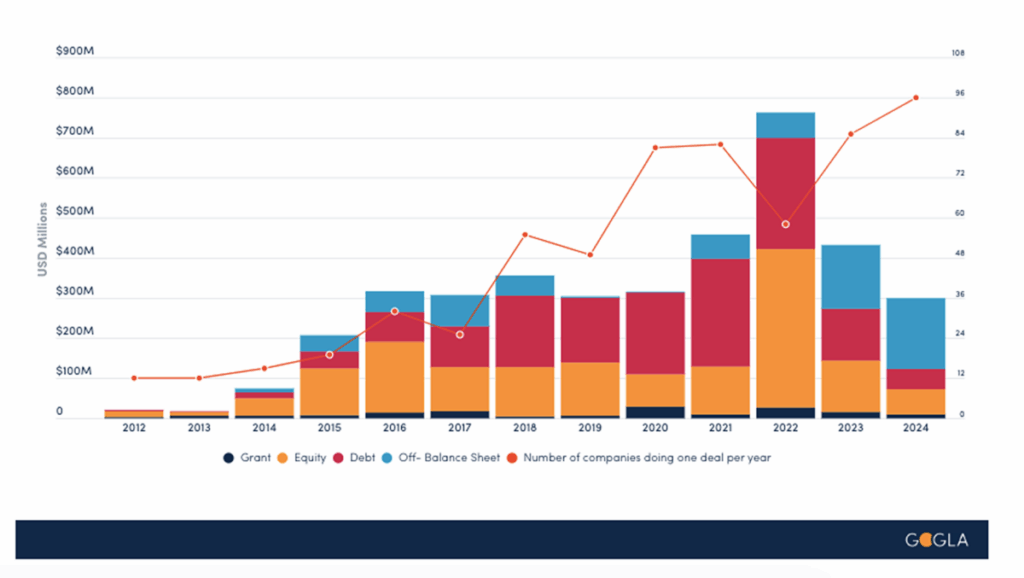

The total investments in off-grid sun companies in 2024 achieved almost $ 300 million, according to Gogla, the Global Association for the off-grid solar energy industry. The 2024 investment database showed a decrease of 30% compared to 2023.

Gogla said that the recession was the most difficult at an early stage of companies and technologies for productive use, what it has added “innovation, scale and impact threatens at a time when the sector is ready for a breakthrough.” The association added that last year marked a turning point and noted that “behind the delay are companies that have adapted to more difficult circumstances, their ability to scale and models have built that balanced financial strength with inclusive impact.”

Scale-ups secured more than three-quarters of the total of last year and raised $ 229 million most through securitizations and structures outside the balance. Gogla said that adult players prove their commercial viability and demonstrate that the sector can yield both impact and returns.

The investments in start-ups, on the other hand, fell by 70%, which, according to the association, reflects wider venture capital trends in Africa.

“The Shakeout is painful but expected – leaving a more resilient cohort of adjustable startups,” the association said. “After a long-term equity crunch, the sector has already undergone a wave of consolidation-which, although difficult, has streamlined the landscape and has turned up a stronger group of capital efficient, impact-driven companies.”

Seed phase companies have collected $ 21 million, which corresponded to the total of last year. A record of 67 sperm phase companies insured financing, with almost two-thirds (62%) of the investments that go to national companies. Gogla said that mixed capital stacks – meeting fairs, equity and technical assistance – open new paths for these companies.

Laura Fortes, senior access from Gogla to Finance Manager, said that the sector has experienced difficult outputs and consolidation, but emphasized the resilience of the remains of the companies.

‘The question is strong, the public value cannot be denied and the chance is real, “Fortes said.” But to unlock it on a scale, we need donors to urgently tackle the affordability gap – so that companies can do where they can be built: deliver. “

The Gogla investment database shows that a new wave of support is created by the launch of patients stock funds, the Green Climate Fund and the M300 initiative. At the end of the decade, the M300 wants to connect at least 300 million people in Africa with access to electricity and prepares on results -based financing schedules to tackle the affordability gap.

“OFF-GRID Sun companies are expected to electrify almost half of the world’s population that currently puts out of development and economic opportunities without access to electricity communities,” Gogla said. “Now that 2030 is rapidly approaching, the determining push will be the determining five years.”

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.