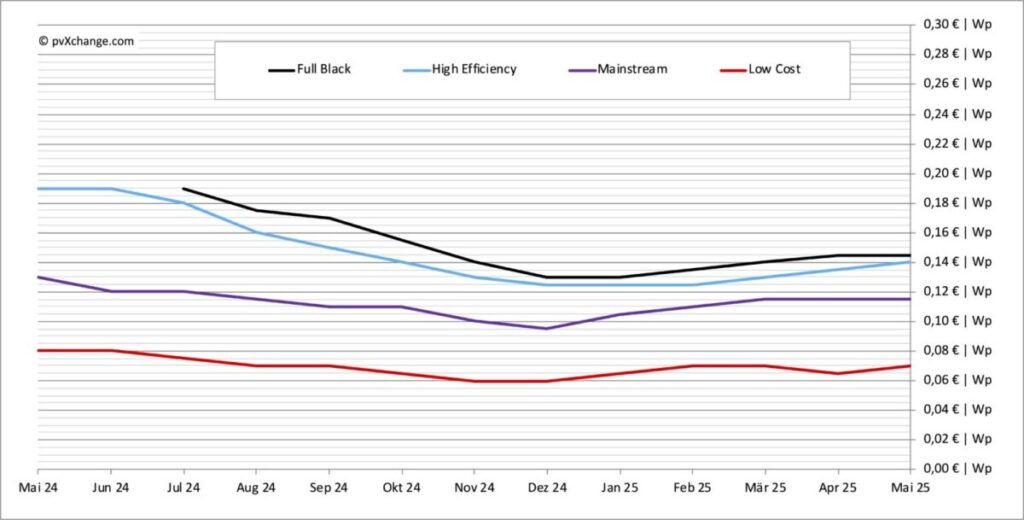

The prices of PV module remain largely flat, despite a slight increases for very efficient products, because slow delivery still has to indicate a clear trend, says Martin Schachinger, founder of PVXCHANGE.COM.

The recovery of the module prices, which followed a sharp fall in the second half of last year, seems to have stalled. Not much has changed in recent weeks. Some wholesalers have somewhat increased prices for highly efficient modules-a indication of continuous supply restrictions but the increases remain too small to suggest a clear trend. Most brands continue to act just below or almost production costs. Predictions based on expected market developments in China point to a further fall in prices later this year as a result of overproduction risks, which manufacturers can put pressure and can cause a new consolidation round in the solar industry.

Many recent developments in the photovoltaic sector remain untenable or miss ecological value. Although market participants often portray themselves as climate leaders, this image is not resistant to control. In the past 20 years, industry has made little progress in sustainability, with some areas even regulating in terms of established processes and structures.

Although some manufacturers advertise that they produce solar modules and cells in a CO2-neutral way, this rarely applies to electricity and electricity processes. Polysilicon, production chemicals and other components are usually made with the help of methods that are far from climate -friendly. Logistics composition The problem, since intervening goods and finished modules often cover large distances on ship and truck, which undergo multiple handings before implementation, so that the entire process is not sustainable.

The waste problem extends to the transport packaging. While the industry has gone beyond the extensive wooden crates that were once used for frame -free thin film modules, disposable pallets, cardboard boxes, plastic belts and films are still stacking on construction sites, with little separation or recycling. In the best cases, installers reuse the outer package to transport dismantled modules during recovery, but the packaging is often too thin to survive reuse.

Recycling regulations at European level require national implementation, but often lack their goals and fail to deliver intended results. For example, the packaging regulation has not powered reuse, reduction or elimination of transport packaging. The European waste from the Electrical and Electronic Equipment (WEEE) Regulation, enforced in Germany via the Electrical and Electronic Equipment Act, remains impractical and inconsistent. Some stakeholders still do not know about the regulation introduced for the photovoltaic industry in 2016.

Such regulations are in principle welcome, aimed at moving the removal costs from taxpayers to polluters and promoting repair and reuse of old devices and components. However, the sector does not yet have to reach the last goal. Many free riders avoid paying recycling taxes or remains not aware of their obligations. In addition, the more than a dozen different land-specific implementation variants of the European Union complicate the cross-border photovoltaic trade, making legal compliance difficult without specialized waste management and recycling service providers.

Although steadily falling solar component prices benefit the end of the consumer by making clean energy more affordable, they also reduce product quality and a long service life. Manufacturers save costs where possible. At the current new module prices, recycling old but functional modules is no longer economically useful, because testing and logistics often cost more than the value of the material. As a result, cheaper removal options are sought and preference over reuse. Many manufacturers also show little concern about effective management of spare parts.

Even before the product cycles fell below six months, manufacturers and dealers avoided the storage of stopped types of solar module. They quickly pushed old stock to erase warehouse space for new products. The market only requires top performance classes or the latest functions. Manufacturers constantly develop new cell types and sizes – and therefore new module formats – that are hardly compatible with older systems. In contrast to the car industry, photovoltaisies do not have spare parts management, so that this remains to a few specialized service providers. But with module prices that fall steadily, this service has increasingly become uneconomical and untenable.

You could expect that the sector of the inverter and the energy storage will be better organized, given the life of the device that is rarely greater than 5 to 15 years. After this, products are outdated and are often replaced by operators. However, products must be repairable within the warranty periods or at least be replaced by identical, compatible units. However, Chinese manufacturers of inverters still have to embrace repairability or backward compatibility.

A repair service provider on the Intersolar Trade Fair in Munich reported that the team of a large Chinese supplier has not been able to offer a replacement printed circuit board for a stringverman that was stopped years ago. The company has not explicitly rejected requests, nor offered a constructive solution. The proposed delivery of new replacement inverters failed because the latest models cannot communicate with a few dozen still operational units. Operators cannot control the entire system with the original software from the manufacturer, so old or new devices are excluded from monitoring. The operator refuses to remove the relatively young inverters and replace it with new ones. This would impose a major financial burden that the company is not willing or unable to wear – and it would be untenable.

Prices in May 2025, including changes compared to the previous month (from 15 May).

About the author: Martin Schachinger Has studied electrical engineering and has been active in the field of photovoltaic and renewable energy for almost 30 years. In 2004 he set up the online trading platform of PVXCHANGE.COM. The company has standard components in stock for new installations and solar modules and inverters that are no longer produced.

About the author: Martin Schachinger Has studied electrical engineering and has been active in the field of photovoltaic and renewable energy for almost 30 years. In 2004 he set up the online trading platform of PVXCHANGE.COM. The company has standard components in stock for new installations and solar modules and inverters that are no longer produced.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content