In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

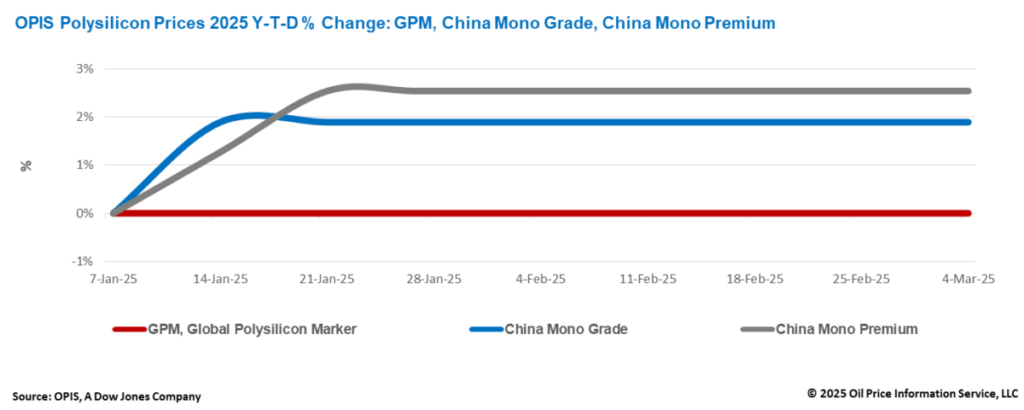

The Global Polysilicon Marker (GPM), the OPIS -Benchmark for Polysilicon produced outside of China, remained stable this week at $ 20,360/kg, or $ 0.046/W, as a result of unchanged market fundamentals.

Trade sources reported the current transaction prices between $ 18/kg ($ 0.041/W) and $ 21/kg ($ 0.047/W), with the price of one supplier under $ 20/kg ($ 0.045/W).

Although the global polysilicon market is maintaining its stability, market participants closely keep the potential impact of various unsolved American trade policy, which could increase the demand for GPM Polysilicon. These include the potential section 232 tariff research into solar products, possible extensions to the non-trainability-compatible entity list, definitive statements about antidumping and counter vailing tasks (AD/CVD) for solar products imported from Vietnam, Cambodia, Malaysia and Tailand, samen-testing-samen—test—test—samen—test—test—test—samen—samen—samen—test—test—test—test—samen-samen—Sande-Staand—Sande-Standen-Standen-Staise-Stanand, Laos, Laos, Laos and India.

According to market sources, the potential section 232 tariff research into solar-related products outside steel and aluminum, namely polysilicon, will take about nine months. However, its impact can be felt much earlier, well before the formal implementation of the policy.

Despite loss, certain large buyers are allegedly satisfactory to their long-term agreements with global polysilicon suppliers through monthly orders. Sources suggest that these buyers are mentally prepared for potential policy shifts and strategically position themselves for future market changes.

The US announced a new rate of 10% last week, with effect from 4 March, which will be added to existing tasks on Chinese input. This step will increase the total rates on Chinese polysilicon, waffles, cells and panels to around 84%, taking into account additional rates under section 201 and section 301.

Although this development is not expected to change the current trading patterns in the global polysilicon market considerably, the wider trend of increasing limitations on products containing Chinese components could ultimately support the demand for GPM polysilicon.

The China Mono Grade, the assessment of Opis for Polysilicon prices of mono-quality in the country, remained stable this week at CNY 33.625/KG, equal to CNY 0.076/W. Likewise, the China Mono Premium, the price assessment of OPIS for mono-grade polysilicon used for the N-type Ingot production, stable on CNY 40.375/KG, or CNY 0.091/W.

Feedback from the industry indicates that the highest signed sales order for N-type Polysilicon is currently on CNY 43/kg (CNY 0.097/W), while the bundled price for N-type and P-type Polysilicon is still around CNY 38/kg (CNY 0.086/W).

The stability in polysilicone prices is attributed to unaltered supply and supply dynamics. Sources noted that maintaining a low operational speed is not only a legal requirement, but also a strategic move based on considerations of production costs. A top-four manufacturer estimated that operating its full annual production capacity of 300,000 tons (MT) would result in a monthly loss of almost CNY 600 million, which emphasizes the economic reasons for limiting production.

Consequently, polysilicon manufacturers are expected to maintain low company rates, generally around 30% to 40%, until prices rise further. Increasing production under current prices and demand circumstances would only increase the inventory and use cash.

At the end of February, polysilicon inventory was reportedly at around 300,000 MT, with more than half of 180,000 MT -in hands of wafer factories. In addition, trade sources project the monthly polysilicon production in the coming months at around 100,000 MT, corresponding to around 50 GW Waffles production per month. This indicates that erasing the existing polysilicon inventory can take a lot of time.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content