Martin Schachinger, founder of PVXCHANGE.COM, says that the European PV market was not affected by the disruptive effects of the new tariff policy of the Trump administration.

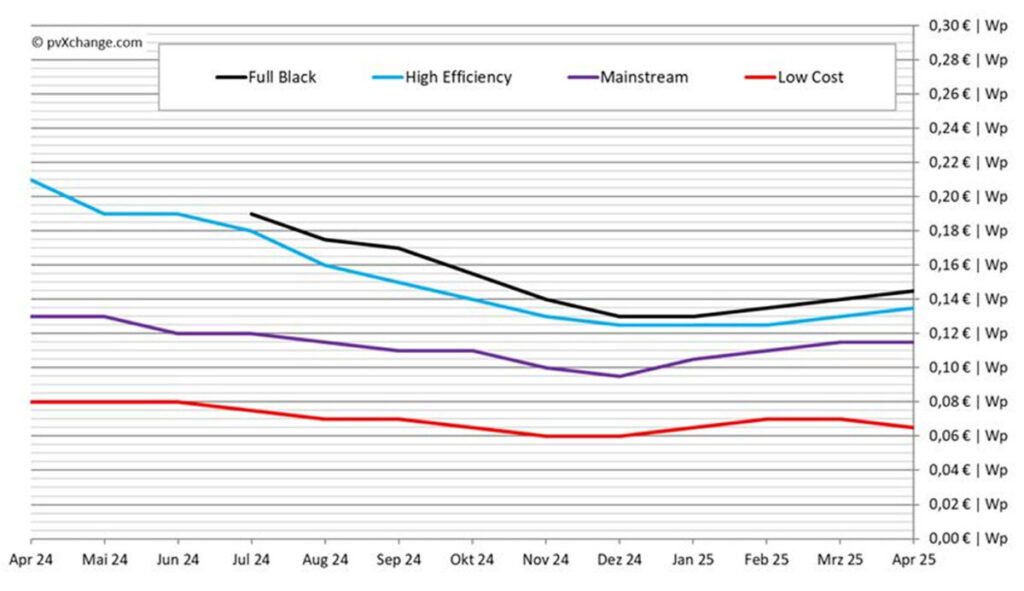

The prices of solar module in Europe rose slightly in April, but this only reflects a trend that is already expected and announced at the start of the year. The price increase is particularly noticeable for highly efficient modules with different afterwards, because there are hardly any offers left in the lower food classes. These products have largely disappeared from the warehouses of wholesalers because of the sale of recent months.

Modules for large roof systems or photovoltaic projects mounted on the ground, which also fall into this technology class, have been available for some time to order. Occasionally large quantities are still on the market of warehouse claries, but because of their age they mainly influence price developments in the cheap segment.

Current worrying developments in the United States seem to have no influence on the European photovoltaic market. American consumers in particular are likely to suffer the most from Donald Trump’s unbridled rate policy in short to medium term. The already seriously limited and thus the import of Asian solar products will be further oppressed as more countries are subject to high rates.

The production that many Chinese manufacturers gradually move abroad will also be influenced by future import speed and will therefore become outdated. A rather popular rate discharge strategy is becoming increasingly difficult, because the long lead time in combination with a lack of planning protection also makes the relocations oneconomically for China.

The situation is becoming increasingly precarious for the few remaining European manufacturers for whom the United States has previously been an important sales market and who have not yet established overseas production. American local production facilities are also struggling with increasing costs for intermediates, which can often only be from China or Asia. That is why it is expected that the already expensive solar technology in the United States will experience a different enormous price increase – very unfortunate for the further expansion of renewable energy in North America.

The loss of one man is the win of another man? This can now offer new opportunities for Europe. Asian products that are originally intended for the American market can now be diverted to Europe, where a new module, in combination with a price war among suppliers and a rapid price decrease, could come true. However, this would mean the end for the already seriously suffering domestic solar industry if the European Union would not counteract this with protectionist measures. On the other hand, the Chinese industry also suffers from low selling prices in Europe and has been trying to combat this for some time.

The prices for photovoltaic products, which are sold at much higher prices in the United States, should be reduced for the European market almost in two. In that case, scaling back production would probably be more economical than the sale of surplus production below the actual cost price in the European Union. Accordingly, I do not expect a significant increase in import volumes, even if the European Commission of new measures would remember to protect the European economy – at least not in the PV sector. The situation can be different in other sectors where prices have not yet reached the pain threshold. At least there are no more indications for a future shortage of stock and the associated price increases in the photovoltaic wholesaler.

However, mixed signals are heard of the installation segment. Companies that have previously focused exclusively on small -scale systems and home storage systems experience a hangover. Even larger installation companies that have previously served the pure scheduled medium to large-scale photovoltaic system segment can count their orders for the coming months on the one hand. Only those solar companies that have tackled commercial storage early and can develop and implement extensive energy concepts for industry and small and medium-sized companies are fairly busy. However, such complex projects cannot be implemented from one day to the next – longer planning and application phases must be taken into account.

There is a whole series of new products with smart checks on the supplier side, in particular for the commercial sector, to meet the high demands imposed by the design of the electricity market on the one hand, and user behavior and self-consumption optimization on the other. Hybrid inverters with outputs up to 50 kW – and soon even up to 125 kW – are no longer unusual. Leading manufacturers also offer step -by -step storage towers that can be expanded in small steps to a capacity of 1,000 kWh. These systems are supported by software that makes the use of all common business models for large -scale storage in the respective raster environment, fully automated and partially supported by AI.

So anyone who thinks outside the frameworks and companies in new business areas should not have a shortage of work in the future. We are only at the start of the urgently necessary low -carbon and energy optimization of commercial and industrial companies – not to mention the extensive electrification of vehicle fleets. Manufacturers and wholesalers offer installation companies both the right products and the concepts and the help with the planning and implementation of more complex projects. The spectrum of opportunities for permanent education in the form of seminars, webinars and specialist literature is now virtually unpredictable. So there is no reason to bury your head in silicon dioxide; There is plenty to do for industry and transactions.

Overview of price points per technology in April 2025, including changes compared to the previous month (from April 14, 2025).

About the author: Martin Schachinger Has studied electrical engineering and has been active in the field of photovoltaic and renewable energy for almost 30 years. In 2004 he set up the online trading platform of PVXCHANGE.COM. The company has standard components in stock for new installations and solar modules and inverters that are no longer produced.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content