The production of solar cells of the US will double in less than two years, driven by growth of domestic content. Anza shares insights in the second quarter of 2025 in the solar-supply chain in the midst of uncertainty.

Anza, a subscription based software platform for data and analyzes, has been released Q2 2025 Insights into domestic content Report that unveils trends in the domestic production of solar modules and Battery Energy Storage Systems (Bess). Although only four months after the last report of Anza, dramatic shifts in the domestic content and trade policy of the US, the Strategic Sourcing team of Anza communicated with manufacturers to update the platform with prices and availability for solar modules and energy storage systems that include rates are brought by the International Emerges1 and Sections and Sections -and Section’s -and Sections -and Section’s -Emerges -and Sections -and Section’s -Emerges -and Sections -and Sections -and Sections -and Section’s -Emerges -Emerges -and Sections -and Section’s -Emerggen1 fives and goals.

Anza analysts note that the result of dramatic policy changes is the uncertainty for manufacturers, developers and buyers, which can cause buyers to postpone purchasing decisions or evaluate sourcing strategies.

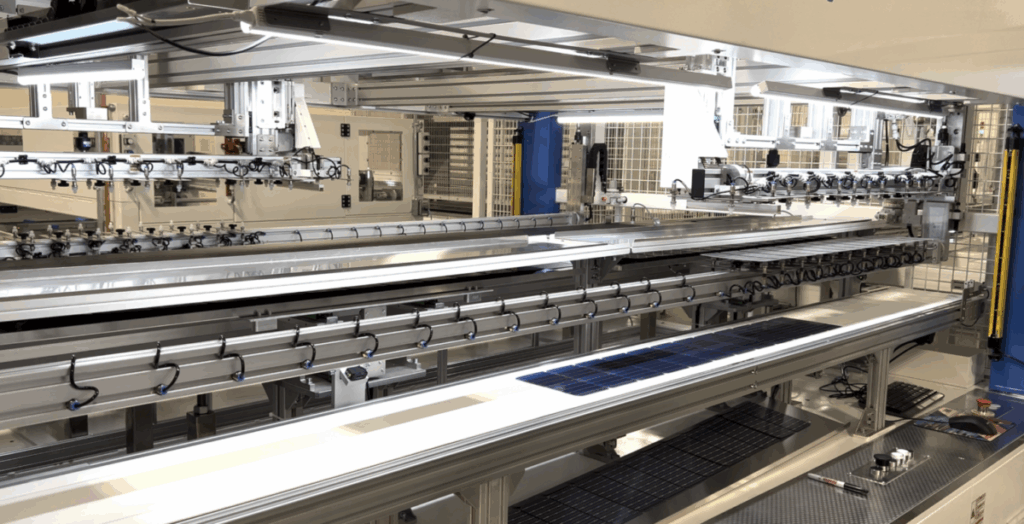

The domestic production strategies continue to evolve in response to shifting market conditions and legal updates. Manufacturers actively adjust their domestic content plans. Some accelerate the American production age lines to take advantage of domestic content stimuli and the prevention of tariff exposure. Boviet SolarFor example, for example, a module facility in North Carolina opened with plans to add cell production next year. Es Foundry already produces cells in his new factory in South Carolina.

Anza noted that other manufacturers have previously canceled announced plans due to financial or logistics limitations. In February Premiere energiesA cell manufacturer based in India stopped plans to produce 1 GW of cells in the United States in the midst of uncertainty. In the same month Freyer Battery Abandoned plans for a battery factory in Georgia. (Freyer then Rebranded as T1 Energy and announced that it will be established a vertically integrated supplier of solar and battery storage in Texas, after the acquisition of the American production activa of Trina Solar.)

Solar modules and cells

According to the Solar Energy Industries Association (SEIA), there have been more than 100 new announcements on solar energy and storage production with 84 new facilities for solar energy and storage that are online, with 55 facilities under active construction.

Anza says that the availability of our assembled modules will fluctuate in the coming years, while the number of suppliers that produce cells and modules made by both the US is expected to gradually increase. To clarify, the American assembly means that the final module is assembled in the United States. All cells made to us are also assembled in the United States.

The good news for the Solar Supply Chain is that the figures rise for both modules and cells, although there is even more module production than cell because cell production takes a larger investment in time and financing. In the Q1 report There were 12 suppliers with our mounted modules and seven cells. The Q2 report shows 17 module suppliers and five cells.

The expectations also rise with time on the module side, but not so much for cells. While the Q1 report Expected 12 module suppliers in the second half of 2025, the current report showed 18. Cell suppliers, however, of the seven expected in the last report to five now -no change in the first half. The graph below shows that it will take until the second half of 2027 for cell suppliers to number in the double digits. However, the gap is expected to close at that time, with 18 module suppliers up to ten cells.

Anza noted that the temporary increase to 20 suppliers in the first half of 2026 in the graph above reflects a short -term obligation that some manufacturers do not want to expand. Similarly, the decrease in the second half of 2026 and the first half of 2027 can be due to an unwillingness to commit.

“Recent rate announcements also ask suppliers to be more careful about long -term projections,” said Anza.

Main collection meals: Anza projected an increase of 100% in the American production of solar cells of five suppliers in 1 hour 2025 to ten in the first half of 2027, indicating a growing commitment to integrate cells made in the production of module by the US.

Battery Energy Storage Systems (Bess)

Anza followed containers, modules and cells, separately, who told an Anza spokesperson PV Magazine USA provides insights into the phases of domestic production and their coordination with IRS guidance. For example, each part of a storage system for battery energy has contributed points under the IRS knowledge of 2025-08, which helps projects to comply with the thresholds of the domestic content qualification qualifications.

This report showed that the Bess sector is experiencing rapid growth in domestic production. The Q1 2025 Projected report that in the second half of 2025 of two suppliers was expected to deliver completely domestic cells, modules and containers. Now Anza predicts that there will be three Bess -Cell providers, seven Bess -Module providers and seven Bess -Container providers.

As shown in the graph below, the predictions become more than triple for suppliers of battery cells from the second half of 2025 to the first half of 2027. The production of domestic module is expected to rise 267% in the same period. Suppliers of containers will more than double from the first half of 2025 to the second half of 2027.

Production -PRAINING DAMICS OF SUNT SCELLEN AND MODULES

Pretend last quarterDomestic solar modules are a lot of demand and short supply. Suppliers charge a premium for fully domestic cells with the American assembly compared to imported cells. Anza said that the reasons for the big question are that manufacturers want to benefit from stimuli and want to reduce the tariff risk.

The Q2 report showed a slight price increase (4.3%) of the cells from December to March, powered by tightening. However, Anza noted that the costs of modules that combine imported cells with our assembled options have not risen as expected. Instead, prices have generally flattened and even fell by 0.4% from December 2024 to March 2025, possibly because buyers need higher domestic content points that can only offer modules with us. Imported modules have experienced a price fall of 6.7% from December 2024 to 2025.

Anza warned that the current price data stretches until March 2025 and do not reflect the effects of new rates. Uncertainty about universal and mutual rates will probably increase prices. The company also noted that trends that are emphasized in this report are based on the current obligations of suppliers and can be changed as the policy and market dynamics evolve.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content