In a new weekly update for pv magazineOPIS, a Dow Jones company, provides a brief overview of the major price trends in the global PV industry.

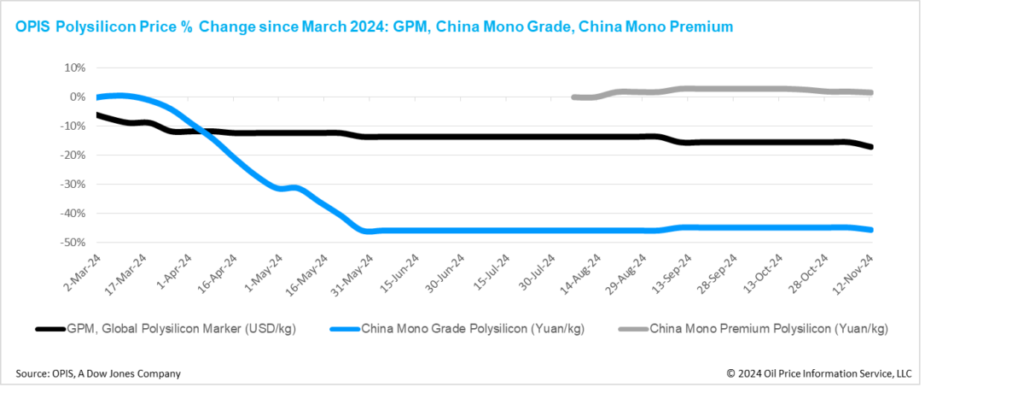

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was valued this week at $21.652/kg, or $0.049/W, down 1.89% from the previous week.

The prolonged lack of strong demand caused by trade barriers has put pressure on prices. Sources indicate that the stagnation in global polysilicon spot trading in recent months, combined with the non-renewal of expired long-term purchasing agreements, has pushed global polysilicon inventories to almost 10,000 tonnes.

This build-up has resulted in lower prices in recent monthly orders under long-term contracts, which are below the formula-based rates set forth in these agreements, with some orders priced $2-$3/kg lower than last month.

Wafer production in the four Southeast Asian countries, which currently serve as the main markets for global polysilicon but may face U.S. anti-dumping (AD) and countervailing duty (CVD) measures on solar cells and modules, is showing limited activity. The largest active block plant in these regions has a capacity of only 4 GW, while the remaining plants have a capacity of less than 2 GW or have suspended operations altogether. Earlier this year, the region was expected to reach a wafer capacity of around 35 GW by the end of 2024.

In terms of new capacity, a Chinese polysilicon manufacturer recently announced a partnership with a local petroleum company to build a 150,000-ton polysilicon production facility in Angola, surpassing the 100,000-ton and 120,000-ton capacities previously offered by two other Chinese polysilicon producers had been announced for projects in the Middle East.

Insiders acknowledge that this project may face long timelines due to significant financing and technological requirements, but highlight the company’s rapid growth: it reached a capacity of 150,000 tonnes in China by the end of 2023, despite being established in 2021 . The completion, scheduled for August 2024, has led to industry speculation that funds are being diverted to overseas expansion, potentially increasing the viability of the Angola project.

China Mono Grade, OPIS’ assessment of mono-grade polysilicon prices in the country, fell slightly week-on-week by 1.49% to CNY33.125 ($4.58)/kg, or CNY0.075/W this week . Similarly, China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used in the production of n-type ingots, saw a slight decline of 0.31% from the previous week, to CNY 39.625/kg, or CNY 0.089/W.

Industry consensus points to rising polysilicon inventories and a deteriorating supply-demand balance. While China’s polysilicon production is expected to fall to around 120,000 tonnes to 130,000 tonnes in November, wafer companies’ substantial production cuts mean their polysilicon needs will be less than 90,000 tonnes this month. Insiders note that, excluding the additional monthly production, existing inventory alone could support more than a quarter of waffle production.

An OPIS study shows that the average operating rate in China’s polysilicon market has fallen below 50%, with notable differences in production levels between manufacturers. Leading producers of Siemens polysilicon and FBR granular polysilicon are reportedly operating at more than 70% capacity, while two other major Siemens polysilicon producers are operating at around 30%. Meanwhile, some smaller plants and factories with lower n-type polysilicon yields have largely halted production.

Insiders suggest that Chinese polysilicon manufacturers are unlikely to reach a 100% operating rate within a year due to severe overcapacity. As a result, some major polysilicon companies are reportedly considering layoffs as a cost-cutting measure to better align with their actual operating rates.

OPIS, a Dow Jones company, provides energy prices, news, data and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmentally friendly feedstocks. It acquired price data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content