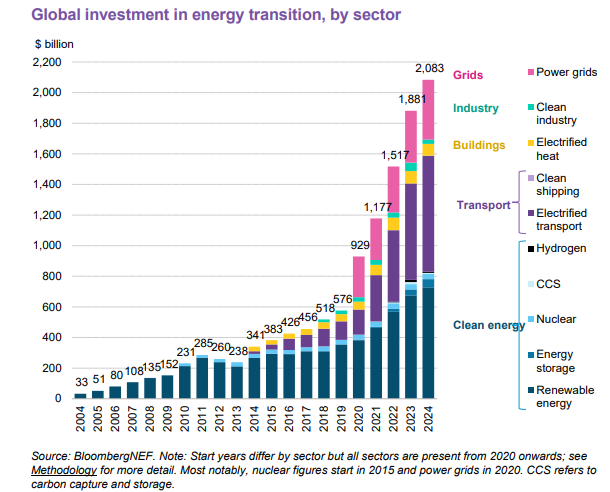

Bloombergnef says in a new report that the global investment of clean energy $ 2.1 trillion reached in 2024, more than doubling 2020 levels. The United States led the issue of energy transition debt and threatened to invests by 5% on an annual basis to $ 206 billion.

A new report on investments in energy transition from Bloombergnef shows that global investments in clean energy technologies have reached a record of $ 2.1 trillion in 2024. This represents 11% growth compared to 2023 totals and is more than double the total investments made in 2020.

The largest sectors were electrified transport at $ 757 billion, renewable energy at $ 728 billion and power boards for $ 390 billion. These sectors all reach record levels last year, where energy storage also reaches a record of $ 54 billion in investments.

Seven other sectors included in the energy transition report of Bloombergnef – nuclear, carbon exit and storage, hydrogen, clean shipping, electrified heat and clean industry – displayed only 7.4% of investments and decreased 23% years after year in 2024.

Bloombergnef’s report posted Global investment In four buckets: Global Energy Transition Investment ($ 2.08 trillion), supply chain investments ($ 140 billion), climate tech sharing sharing ($ 50.7 billion) and issue of energy transition debt ($ 1.01 billion.)

Bloombergnef said that mainland China ‘returned to the steering place’, good for two -thirds of the global increase in 2024.

Despite investments in the trillions, Bloombergnef estimated that the world is far behind its net noise. It said that the investment is only 37% of the levels needed for the rest of this decade when the world is on its way for Net Zero by 2050.

Clean Energy Supply Chains received $ 140 billion in investments. Supply Chain of Production Investments declined in 2024, which fell to solar, battery, battery metals and electrolyzer production in a state of overcapacity.

Energy transition depreciation reached $ 1 trillion in 2024, led by the United States, which grew its investments by 5% on an annual basis to $ 206 billion, followed by China with $ 169 billion.

“Many sectors increase the debts for the transition – clean energy companies are only 5% of the total. Utility companies are the largest fundraisers. Follow governments and financial data while subsidizing, investing or borrowing the value chain, “said Bloombergnef.

The report also noted that the struggle in venture capital investments in climate and energy was in 2024. In recent years, the market for climate venture was more resilient against wider market struggle, but this returned in 2024 and dollars in the climate in the climate 40% despite venture financing in despite venture financing in despite venture financing in despite venture financing in despite Venture financing in despite venture financing in despite venture financing in despite venture financing. The economy is increasing. Capital that was collected via the first public offer reached $ 6.2 billion in 2024, 85% less than the total in 2021.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content