International PV module prices, powered by Chinese averages, will probably increase from $ 0.08/W to $ 0.10/W today to $ 0.11/W by the end of 2025 and possibly $ 0.13/W against 2027, says Clean Energy Associates (CEA), which is now 12% of the heterojunction and back-in-heterojunction and back-in-heterojunction and back-to-back that heterojunction and back-in-thejunction and back-in-thejunction and back-in-the-feat. deliver module capacity.

CEA has predicted that the prices of solar module can rise from around $ 0.8/W to $ 10/W currently to $ 0.11/W at the end of 2025 and probably up to $ 0.13/W against 2027.

“Despite the control of the government that limits extensions through the Chinese Ministry of Industry and Information Technology, which has released stricter rules for new PV capacity investments and added additional requirements and increased standards for existing PV factories, the government’s action has no influence on the overshadiger told,” told, ” -Plisher, “told a CEA spokesperson,” said a CEA spokesperson, “said a CEA spokesperson,” said a CEA spokesperson, “said a CEA spokesperson,” PV -Magazine. “Suppliers respond to low prices by reducing costs and reducing the stationary capacity, but financial data remain an important care for all suppliers who want to survive colleagues in the industry.”

CEA analysts said that there is an important question when mass consolidation of suppliers and capacity closures will come on the market. After a year of long-term price drops and free or under-cost production, they expect suppliers to leave the industry in 2025.

“The availability of adult tool providers and the ability of the Chinese market to quickly build, tools to be built new production capacity are constant ensuring PV suppliers. This dampens prospects for a substantial price increase because many production nodes have a relatively short time,” the spokesperson said. “Relocating some polysilicon plants can be relatively short if modern lines are motivated during the closing of suppliers and there is a different price crunch.”

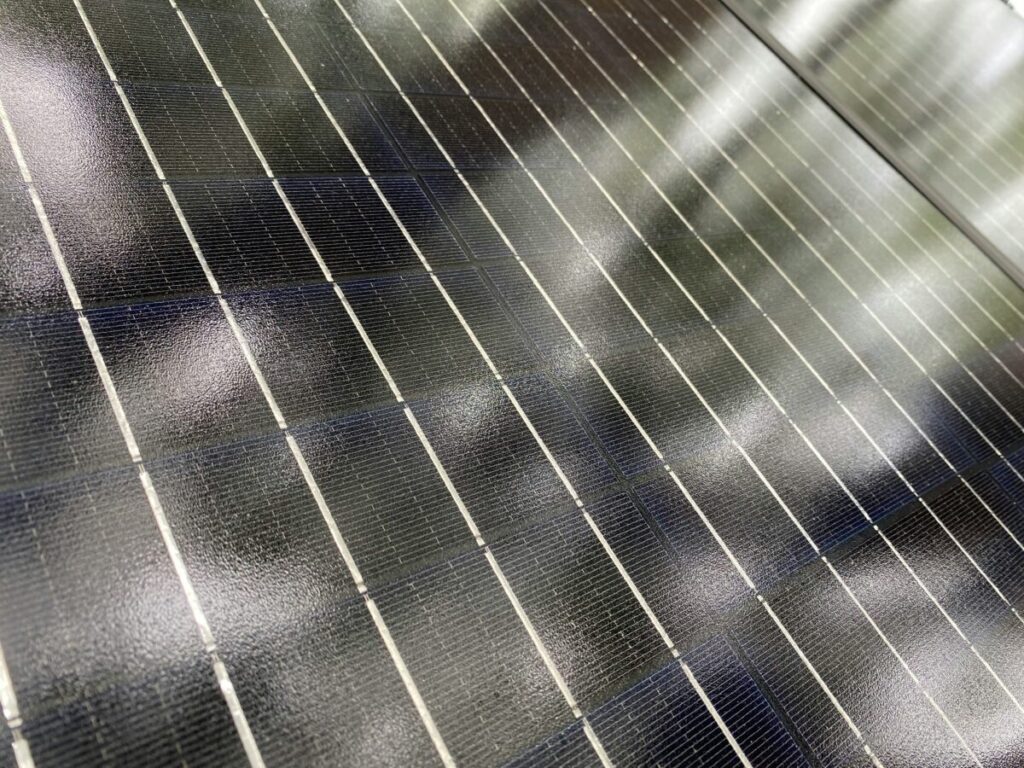

CEA said that China currently has 1,040 GW operational capacity, an increase of 996 GW at the end of 2024, but under the prospects of 2025 of 1,218 GW. Heterojunction (HJT) accounts for approximately 7% of all cell production capacity, with 97 GW of operational factories, while back contact (BC) – usually tunneloxide passivated contact (topcon) BC – forms around 5% or 73 GW.

CEA noted that these technologies represent a much smaller -installed share worldwide – probably each below 1% each – each – because of the long dominance of passivated emitter and rear cell (PERC) in the past five to 10 years and the recent rise of Topcon as the regular product of the industry.

“The rise of price-competing HJT for Utility applications is more recent, and although there are contact products available for applications on Utility scale, HJT and BC-Prominent Use-Cases Distributed Generation Markets,” the spokesperson said.

In his first quarter Solar reportCea revealed that project costs with the help of N-type products have now set the basic line, such as Passivated Emitter and Achter Cell (PERC) Technology phases from the market. Only markets with trade barriers on China, such as the United States, still use a mix of perc, n-type and other technologies.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.