In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

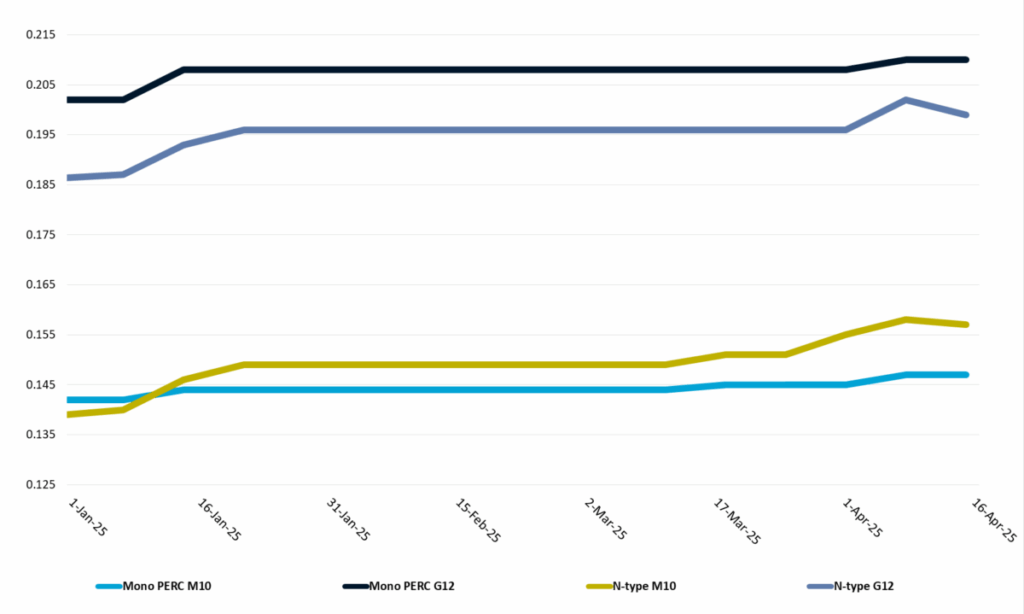

FOB China prices for Mono Percs waffles remained stable this week, with M10 and G12 waffles that were stable at $ 0.147/PC (each) and $ 0.210/PC respectively. FOB China prices for N-type waffles, on the other hand, experienced a decrease. N-type M10 waffles fell to $ 0.157/PC, while G12 waffles fell to $ 0.199/PC, which reflected the decreases from week to week of 0.63% and 1.49% respectively.

The recent increase in demand for end user installation in China-powered by two solar energy policy planned to be in force in May and all of them to close. This relaxation of demand has led to a more relaxed supply environment in the Wafersmarkt and has contributed to the prices of this week.

In the meantime, the output of the China wafer for April, initially projected at around 57 GW because of the expected disruption of Myanmar earthquake, has been revised up to around 61 GW based on updated production schedules of wafers manufacturers. Sources from the industry indicate that the production capacity of the sector has effectively included the impact of the disruption. These developments have further strengthened the prevailing pessimism with regard to the prospects for the China waffle market.

On the global market, US President Donald Trump has announced a three -month suspension of all ‘reciprocal’ rates, with the exception of those applied to China. As a result, countries such as Laos and Indonesia, important recipients of Southeast Asian waffles, will be confronted with only a basic line rate of 10% on cells and modules that are exported to the US during this window.

Although no official confirmation has been issued by manufacturers, industry -insiders speculate broadly that the production rates in Southeast -Asia will probably increase in the short term. The aim is to accelerate shipments to regions outside the four countries that are aimed at the AD/CVD study, whereby waffles can be further processed in cells and modules and can be delivered to the US before the three-month rate ends.

In the long term, it is expected that evolving international trade policy will reform the export landscape for Chinese and Southeast Asian silicon waffles. In addition to complying with local market demand, the American market remains a critical export destination of solar cells, because domestic cell production in the US remains inadequate in complying with the requirements of its production sector module. Consequently, the US will probably retain its dependence on imported cells, mainly from countries that are subject to relatively lower extensive rates.

Regions such as South Korea, India, Egypt, Ethiopia, Turkey, Saudi -Arabia and Oman – where the production of solar cells is already established or is currently being developed – is expected to come forward as important destinations for the export of the wafer. Market sources emphasize that these regions offer favorable tariff environments and probably play an increasingly important role in the global wafers trade.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content