In a new weekly update for PV -MagazineOpis, a Dow Jones company, reports that pessimism in the global polysilicon market is deepened, powered by an persistent oversupply that exceeds the total monthly purchasing volumes of buyers. Various global polysilicon buyers have confirmed that maintaining substantial stocks, which has contributed to the current modest trading activity.

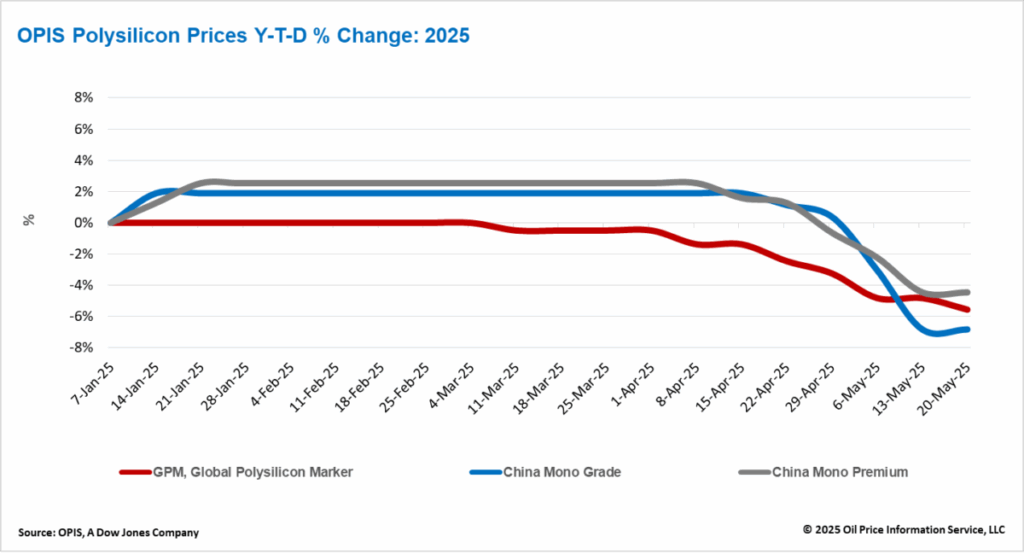

The Global Polysilicon Marker (GPM), the OPIS benchmark for Polysilicon produced outside of China, was rated this week at $ 19.233/kg or $ 0.040/W, which reflects a decrease of 0.76% of the Buy-Sell’s reported last week.

Pessimism in the global Polysilicon market is deepened, powered by an persistent oversupply that exceeds the total monthly purchasing volumes of buyers. Various global polysilicon buyers have confirmed that maintaining substantial stocks, which has contributed to the current modest trading activity. One market participant also noted that their INGOT production activities in Southeast Asia are currently working at levels that only consume about half of the monthly polysilicon volumes that are protected by long-term contracts, which indicates the continuous accumulation of global polysilicon stocks.

Nevertheless, some buyers are reportedly continuing with the placement of mockers that go beyond their contracted obligations. These transactions are mainly powered by the larger price bending offered by place purchases, which buyers use to diversify their supply sources at lower costs and better manage future risks.

Suppliers are said to remain aimed at potential growth in orders for solar modules and cells that were exported to the US, viewing trends as important indicators of a broader global demand for polysilicon.

In addition, the production projects of the solar cell of Indonesia are reportedly accelerating the expansion, which could modestly increase the demand for waffles derived from the global polysilicon.

Market participants see that the historically stable relationships between buyers and sellers gradually work out, so that more fragmented trading patterns and irregular orders are considered, and note that a new dynamic in transactions and customer relationships is emerging.

The China Mono Grade, the assessment of opis for polysilicon prices of mono-quality in the country, remained stable this week at CNY 30.750 ($ 4.27)/kg, equal to CNY 0.065/W. Similarly, the China Mono Premium, the price assessment of OPIS for mono-grade polysilicon used for the N-type Ingot production, stable on CNY 37.625/KG, or CNY 0.079/W. Both prices remained unchanged compared to the previous week.

Polysilicone prices remained stable this week after five consecutive weeks of decline, mainly as a result of muted trading activity and the lack of price adjustments by large producers, according to trade sources. Waffel manufacturers have reportedly taken over a more careful purchasing approach, whereby Polysilicon at a slower pace and in smaller volumes in the midst of stubborn Bearish sentiment with regard to the short -term prize prize -views on the photovoltaic supply chain.

The continuous decline of the market has also increased expectations for further reductions in the production of polysilicon. Two new projects in Qinghai – with an annual capacities of 100,000 MT and 50,000 MT respectively – were initially planned to start the production of test and to increase production in the second quarter. Given the current price levels and weak market front views, industry insiders believe that it is unlikely that these producers will launch products in the short term.

In an attempt to enter into the ongoing market challenges, several sources have indicated that industry is considering a consolidation plan in which the six largest polys silicon producers would acquire all remaining small -scale production capacities. At the same time, a leading manufacturer reportedly suggested a coordinated initiative among producers to jointly limit the output, with the aim of stabilizing the prices within a reasonable range.

However, sources warn that significant uncertainty surrounds both feasibility and the future direction of the acquisition proposal. An important obstacle lies in coordinating the different interests of investors, acquisition goals and local authorities, which complicates the efforts to establish a uniform consensus. Furthermore, sources noted that determining a standardized acquisition price – based on the scale and output volume of the intended polys silicon capacities – will be essential for this plan to move forward and be implemented.

Wide pessimism around the market demand in 2025 is now putting down a downward pressure on the Chinese Polysilicon Futures market. According to data released on 19 May by the Guangzhou Futures Exchange, the future prices for Polysilicon deliveries from June 2025 to April 2026 have all fallen under CNY 40/KG. The highest settlement price, for the delivery of June 2025, was on CNY 37.04/kg, which represents a fall of 1.55% compared to the current spot price that was assessed by OPIs this week.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content