A new report from Wood Mackenzie examines how the global shift to higher interest rates to combat inflation is putting pressure on the energy transition.

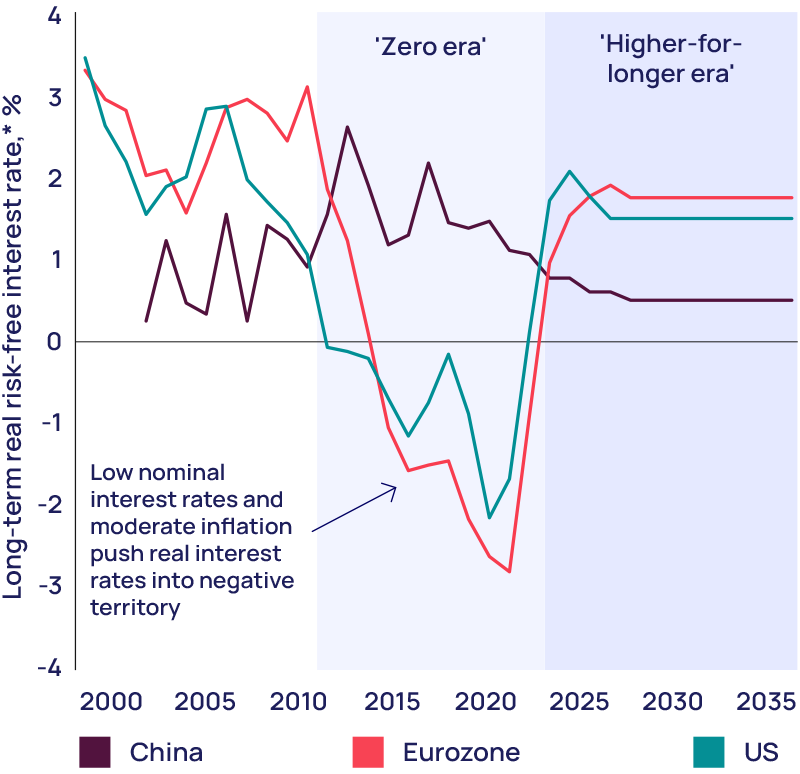

After a period of historically low interest rates from 2009 to 2022, central banks sharply raised interest rates to combat inflation. Rising capital costs have “profound implications” for the energy and natural resources industries. Wood Mackenzie said in a recently published report.

The transition to a net-zero economy could require $75 trillion in investment globally by 2050, the research firm said. The higher capital costs pose a challenge to the transition to low-carbon technologies in terms of cost and pace.

Wood Mackenzie said the economy has moved away from “zero-era” numbers after the Great Recession and will likely continue to do so for decades to come.

Members of the US Federal Reserve have reiterated a “higher for longer” sentiment on rates in recent months. Globally, structural inflation trends such as global trade realignment, deglobalization and the emphasis on nearshoring industry and employment over raw macroeconomics could keep interest rates high for a while.

“Highly capital intensive and often dependent on subsidies, low-carbon energy and emerging green technologies are the most vulnerable [to high rates],” the report said. “Debt represents a larger part of the capital structure for low-carbon energy sectors.”

Wood Mackenzie said the oil and gas industry, while also highly capital intensive, is much less exposed to the cost of debt and therefore less affected by the higher interest rate environment. Gearing, or the debt-to-equity ratio, is typically higher in renewables and nuclear development than in mining, oil and gas.

“Bond and project finance debt, backed by long-term energy purchase agreements, has been used to finance the rapid growth of renewables,” said Wood Mackenzie. “Although energy and sustainable energy companies have higher gearing, they do compare favorably with other comparable groups in terms of debt burdens.”

Renewable investments have greater price certainty than their oil and gas counterparts, making them a less risky investment and enabling lower financing costs. Moreover, the The levelized cost of electricity (LCOE) for new solar construction is now 29% lower than any alternative to fossil fuels, according to Ernst and Young. Of Solar panel prices continue to fall to record lowsThis cheaper, predictable source of electricity can serve as a powerful fighter against inflationary pressures in the long term.

Interest rates have put pressure on this LCOE advantage, Wood Mackenzie said. Her analysis shows that a 2 percentage point increase in interest rates leads to an LCOE increase of 20% for renewables, and 11% for a combined cycle gas turbine power plant. Still, Wood Mackenzie said renewables have an advantage in LCOE, even without subsidies.

While it is difficult to estimate the dollar cost of damage from climate change and what a transition to net-zero emissions would do to limit the damage, a report from the Potsdam Institute in Berlin estimates annual climate-related costs at 38 trillion dollars. per year by 2050. Faced with these costs, the $75 trillion global price tag for transitioning the global economy to net-zero emissions seems more palatable.

While the oil and gas industry is less affected by higher interest rates, and oil giants have significantly reduced their debt levels between 2020 and 2023, Wood Mackenzie said the availability of financing could pose problems for the fossil fuel industry. Environmental, social and governance concerns are contributing to a shrinking list of lenders, the report said.

Wood Mackenzie said governments must continue to subsidize the energy transition to encourage investment, despite rising debt and debt service costs. It recommends a strategy that focuses on efficient, non-discriminatory subsidies strengthening global carbon marketsand the mobilization of climate finance.

“Policymakers must take action to offset interest rate headwinds. Removing barriers such as slow permitting and project approval and providing clear, consistent and sustainable incentives will support emerging low-carbon technologies,” said Wood Makenzie. “Strengthening global carbon markets, maximizing subsidy efficiency and mobilizing green finance are also essential. A higher interest rate environment could be what is needed to spur policymakers into action.”

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.