The American solar production was flown in sharply in the first quarter of 2025, to support record levels of new capacity because solar energy and storage were 82% of the additions to the grid. But proposed legislation and rising import rates can cloud growth.

The 8.6 GW of the production capacity of a new solar module added in the first quarter of 2025 marks the second largest quarter for new production capacity, according to the “US Solar Market Insight Q2 2025” report Through the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

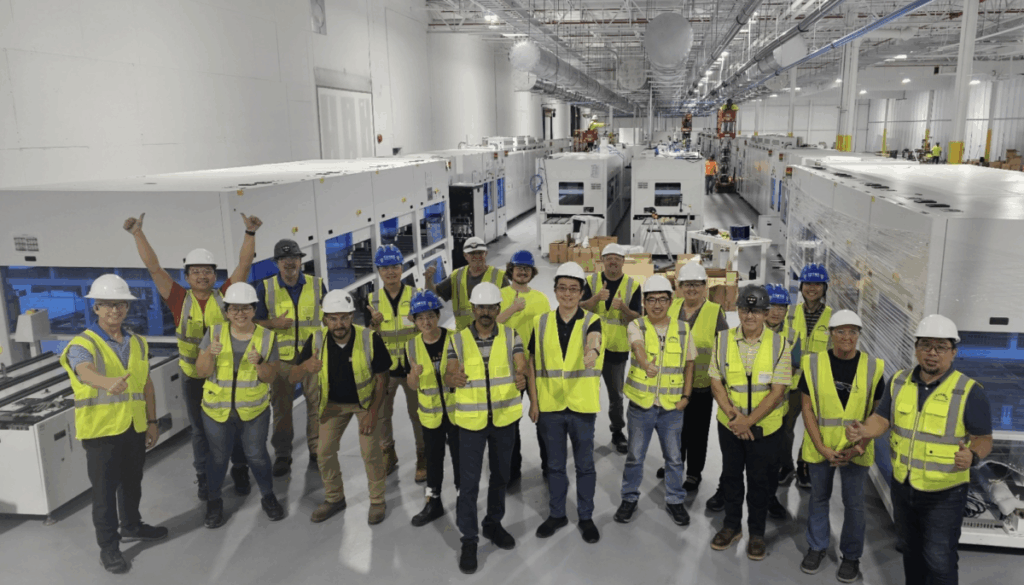

In addition to the growing module capacity, the production capacity of the American solar cell in the first quarter doubled to 2 GW with the opening of the Es Foundry Factory in South Carolina.

The American solar generation grew by 10.8 GW in the first quarter, powered by rising production capacity. According to the report, Solar and Storage accounted for 82% of all new grid supplies.

While solar production and implementation continue to stimulate American energy independence and growth, new rates and potential changes in federal tax credits continue to create considerable business uncertainty and they threaten the long-term provision of the sector, according to the authors of the report.

The industrial prediction of SEIA and Wood Mackenzie, which includes rates that are imposed in the second quarter, but not the possible recovery of federal tax credits, projects a national decrease in deployment. The analysts warned that this could lead to lost investments in local communities, energy shortages and higher electricity accounts for American consumers.

“Rolbacks of the Energy Tax Credits, on top of recently raised rates, would unambiguously worse the damage to the solar industry,” said the report.

A separate analysis of SEIA of the effects of the possible passage of the Bill Bill of the American house projects a devastating energy shortage for the American economy. This analysis showed that as legislators in the Senate do not change course, 330,000 current and Future American jobs can be lost331 factories can close or never come online, and $ 286 billion in local investments can disappear.

If the American Congress reduces energy tax stimuli, SEIA’s analysis projects that energy production will fall 173 TWH and the United States will not be able to meet the demand or compete with China in the worldwide race to Power AI.

The report noted that various factors influence different sectors of the market, such as high interest rates “and other market winds” that will continue to float the residential market.

The report noted that various factors influence different sectors of the market, such as high interest rates “and other market winds” that will continue to float the residential market.

The American residential solar market has been back for some time, initially in response to high interest rates, but also as a result of cutbacks in net measurement, as seen in California. The market recently witnessed the bankruptcies of the large national installation program Tanningresidential solar money, Mosaic and a subsidiary of Sunnova Energy. The report stated that in the first quarter of 2025 the residential solar market 1.1 GW (DC) added, which represents a decrease of 13% on an annual basis and 4% quarter-over-quartaal decrease. Compared to the first quarter of 2024, 22 states experienced drops in installed capacity.

In contrast to the tumbling residential sector, the commercial solar market reached its record-first quarter of the installation capacity in the first quarter of 2025, with 486 MW (DC), an increase of 4% on an annual basis.

Community Solar requires state policy, but with less than half of the states that have established a supporting policy, the sector is in danger, according to the SEIA/Wood Mac report report. The report of the first quarter predicts that without extra programs throughout the state, the community growth of the community will stagnate until 2030. In the first quarter of 2025, the community installations of the community fell 22% after year, which resulted in 244 MW (DC) of new capacity. Some states did worse than others. In Maine and Massachusetts, for example, the installed capacity fell by 85% and 78% years after year respectively.

Utility-Scale Zonne-Zon has had an upward process, but policy uncertainty ensures that some major projects are deleted. The report noted that the sector on Nuts scale 9 GW (DC) of projects installed in the first quarter of 2025, which represents a fall of 7% on an annual basis. The top five states with the largest installations are Texas, Florida, Ohio, Indiana and California, which make up more than 65% of the total installations this quarter.

Look forward

Although the Federal Policy of the US and the tariff risks cause uncertainty, the report identified the growth of accelerating the tax, driven by the proliferation of data centers, as a more predictable trend. It mentioned the impending demand increases and sustainability goals for companies such as the primary motivations of solar deployment.

In his basic case, the report was projected that the American solar market will add more than 250 GW (DC) by 2030, while noting that policy and tariff risks remain important. The prediction contains the most recent rate announcements.

“In addition to the 25% rates in Canada and Mexico, we assume rates in the next 90 days, including a rate rate of 30% for China in 2025 and 2026, and a rate of 10% for all other countries,” the report said.

However, the prospects were not taken into account of the Budget Reconciliation Bill. In general, the uncertainty of possible changes in tax credit policy and rates will cause the American solar industry to contract by 2% annually in the basic case of the report by 2030.

Other factors that hinder growth include labor shortages and delayed of interconnection. Even with the expected contraction, however, the report expects an average of 43 GW (DC) to be added to the grid every year until 2030.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content