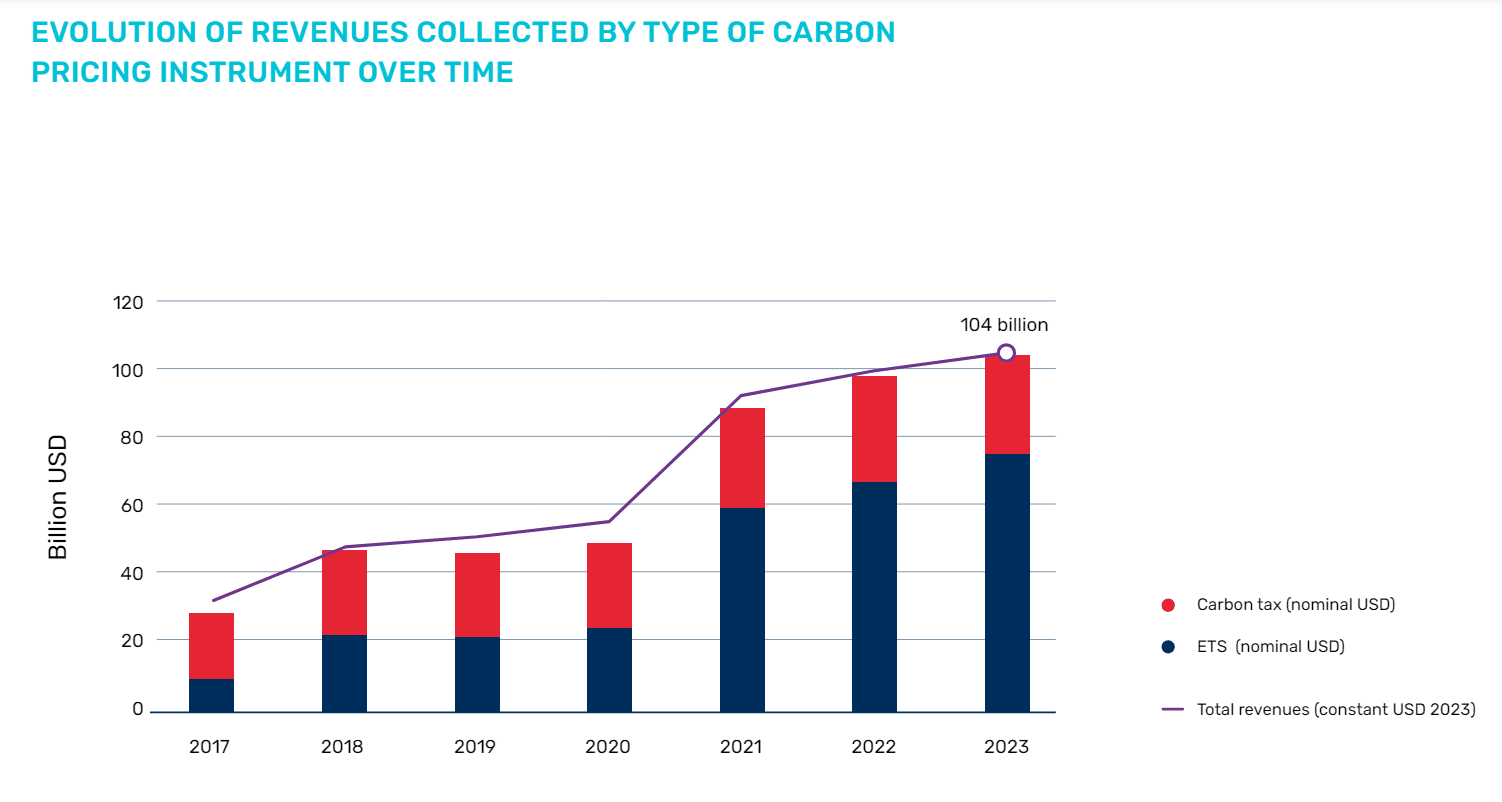

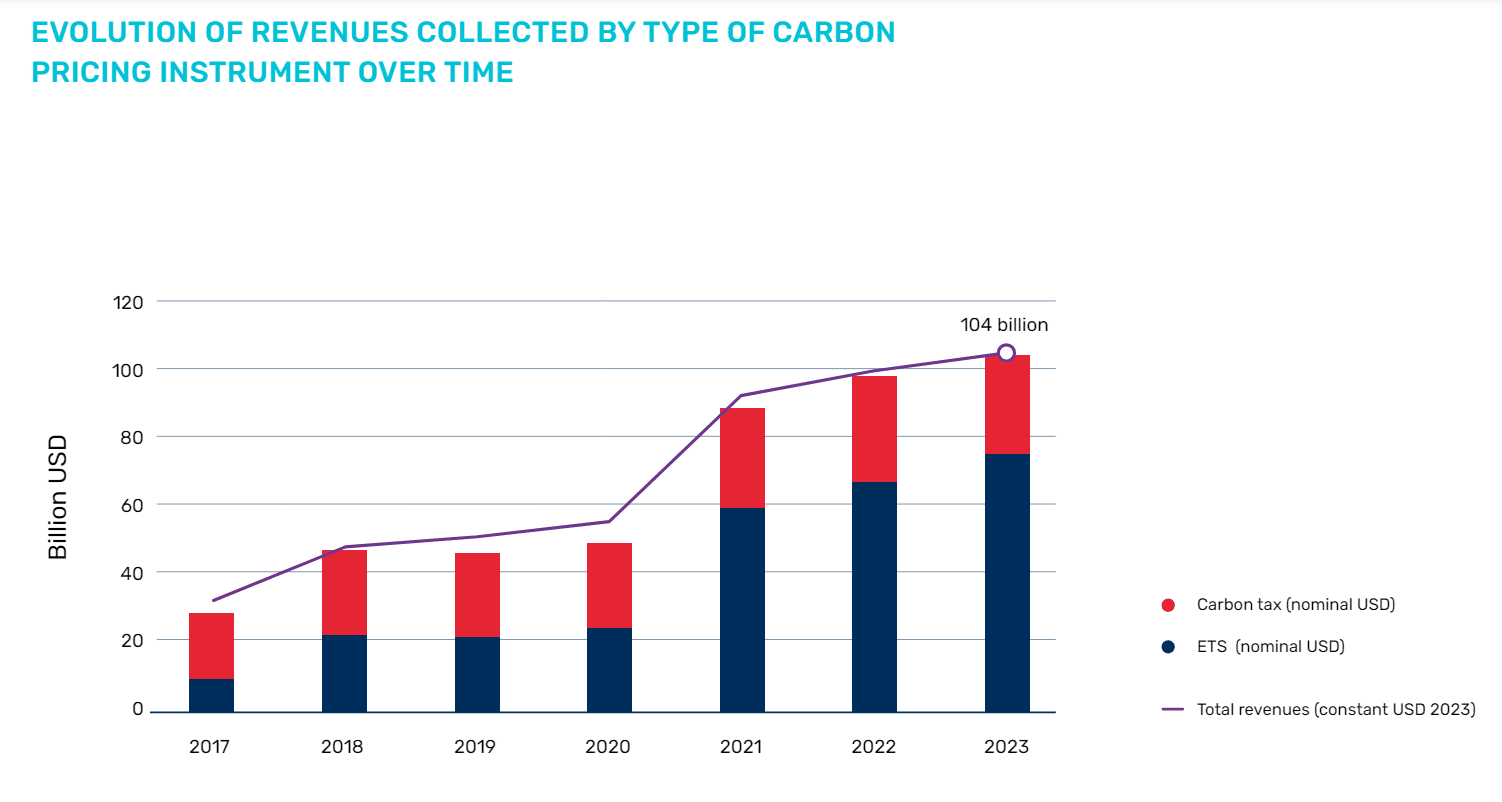

A World Bank report shows that countries with carbon pricing mechanisms generated a record $104 billion in revenue last year. More than half of the funds went to climate and nature-related programs.

Carbon pricing, implemented through carbon taxes or emissions trading systems (ETS), is key to reducing emissions and promoting low-emissions growth.

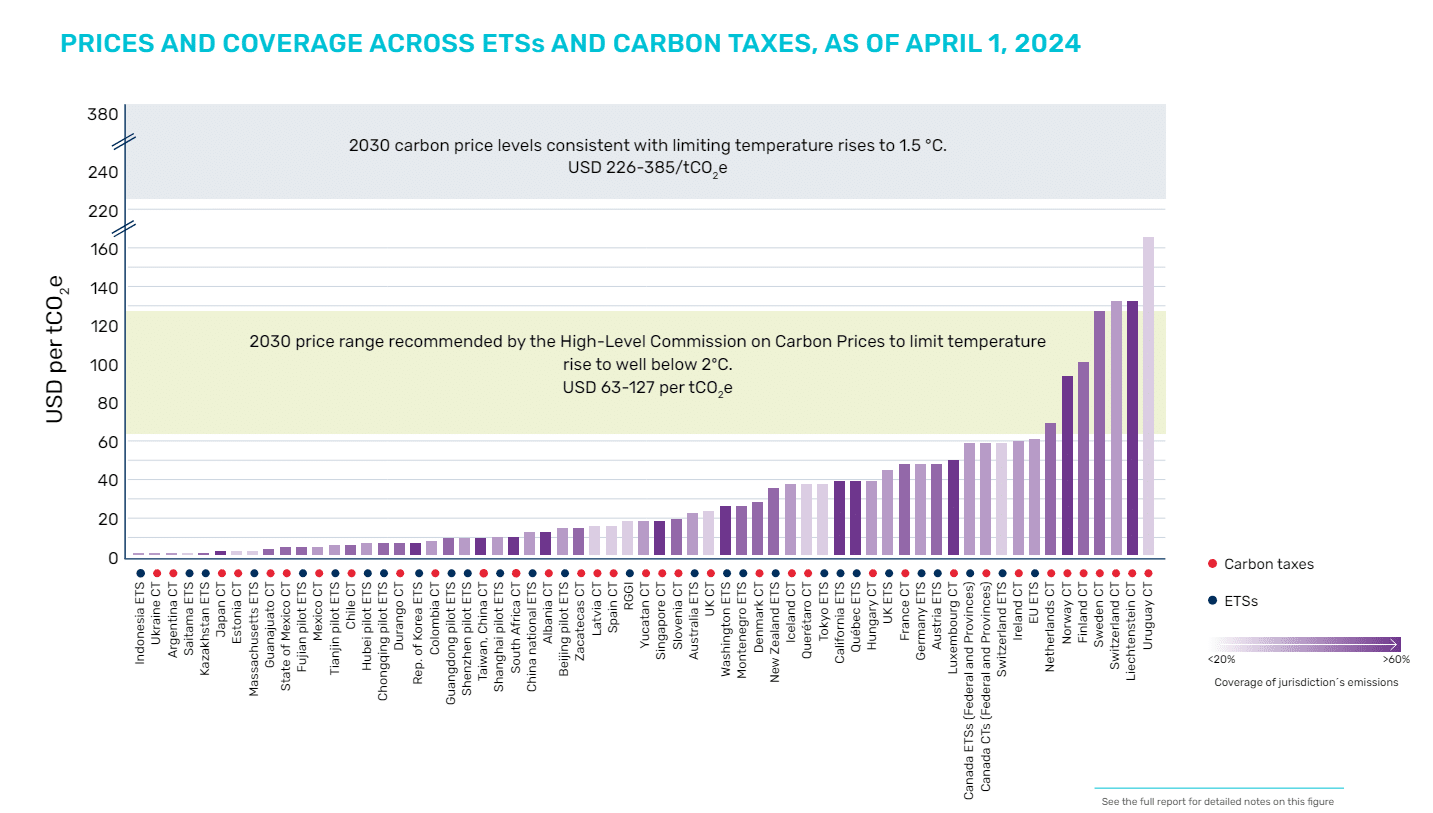

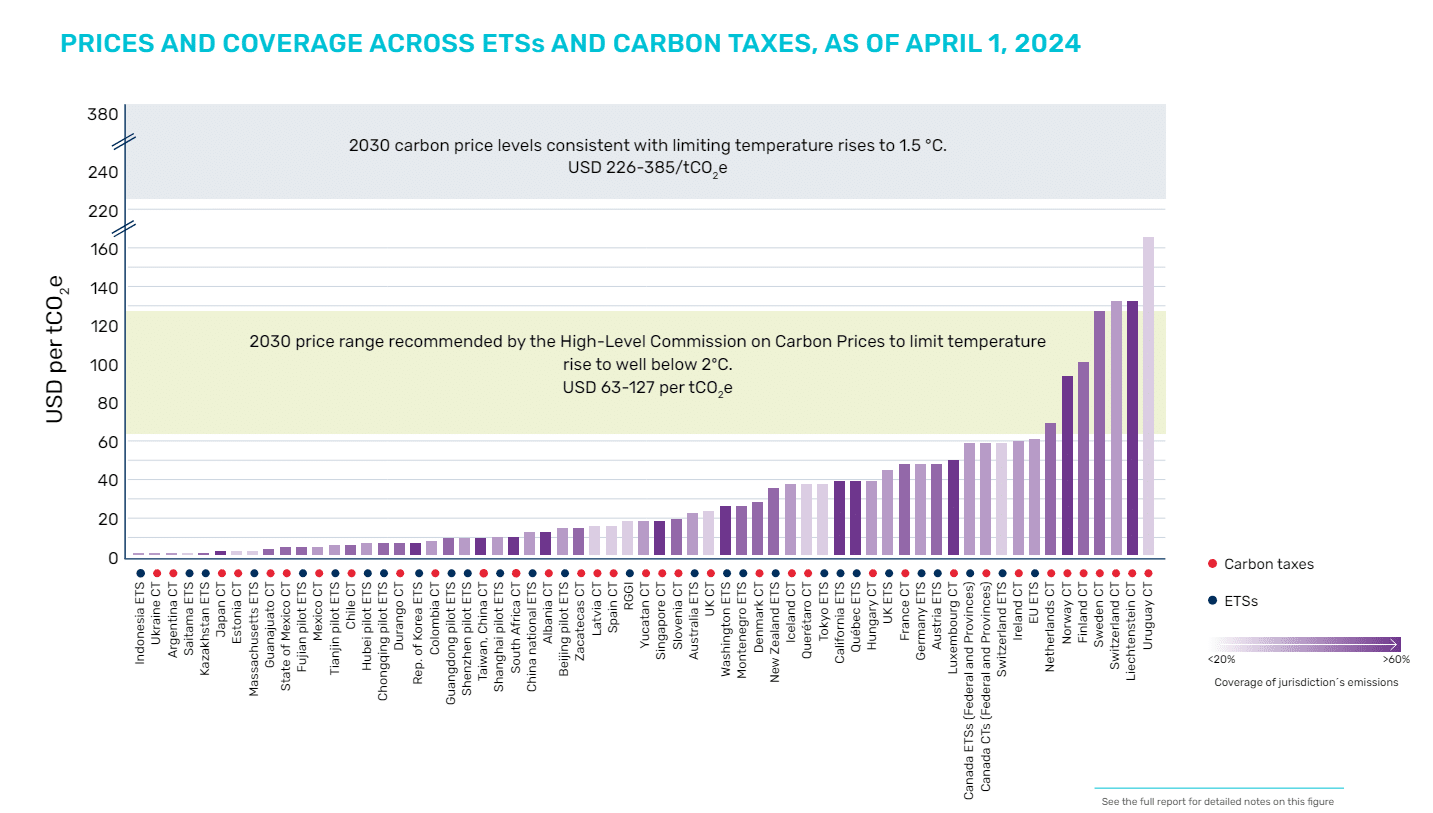

Despite this achievement, the report highlights that current carbon taxes and emissions trading systems remain insufficient to meet the climate targets of the Paris Climate Agreement. While 24% of global emissions are covered by some form of carbon pricing, less than 1% is subject to prices high enough to limit temperature rise to less than 2°C.

The High-Level Commission on Carbon Price has recommended that the carbon price in 2030 should be between $50 and $100 per tonne. Adjusted for inflation, this price is now between $63 and $127 per tonne.

The World Bank emphasizes the need for greater coverage and higher prices to significantly reduce global emissions and support the transition to a low-carbon economy. Here are the key takeaways from the WBs “State and trends of carbon pricing in 2024.”

Increasing acceptance by middle-income countries, but carbon prices remain insufficient

Over the past year, carbon pricing adoption has been limited, but there are promising signs of adoption in middle-income countries.

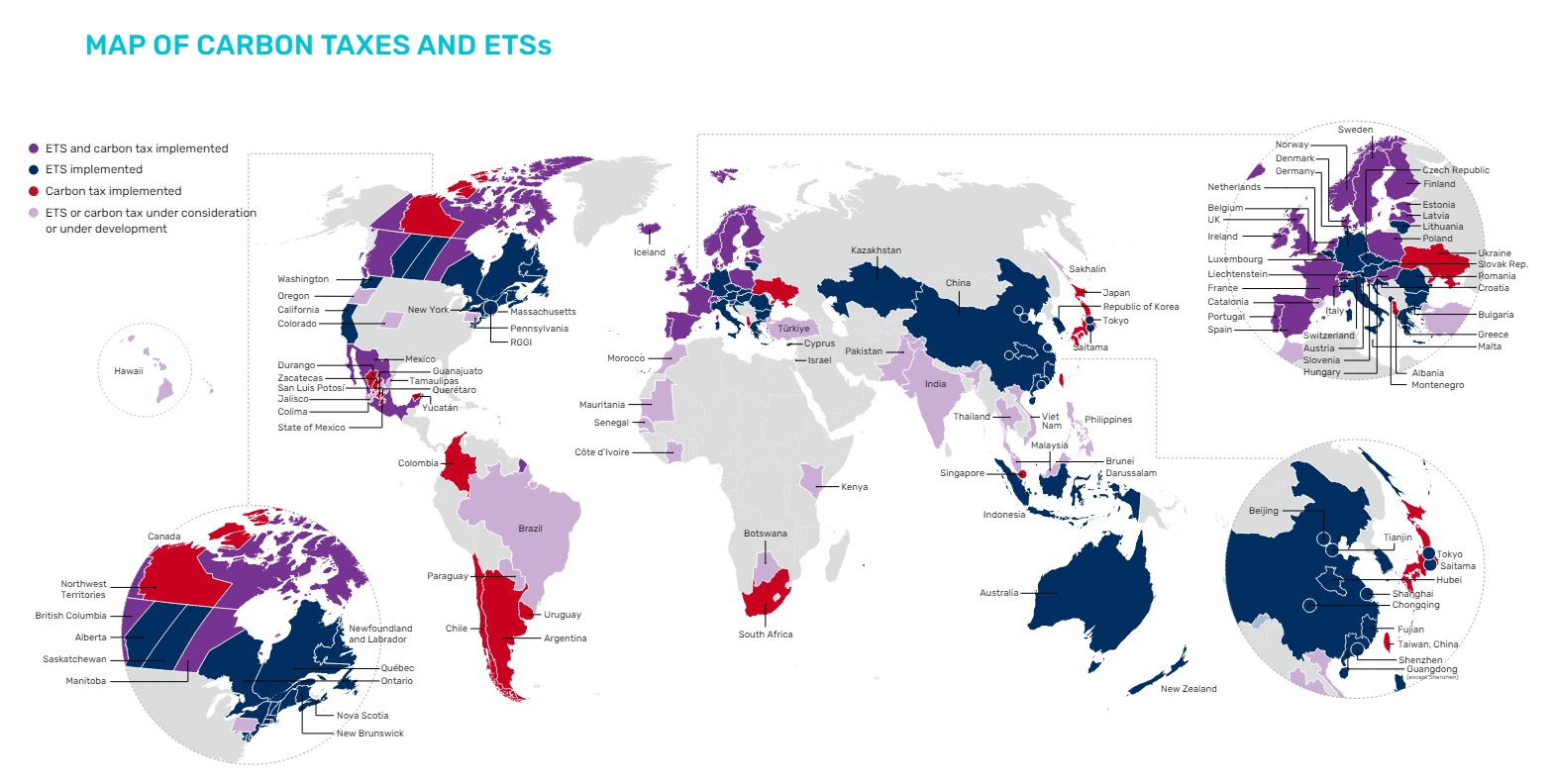

There are currently 75 carbon taxes and emissions trading schemes in place worldwide, reflecting a net gain from two carbon pricing instruments over the past twelve months. In particular, middle-income countries such as Brazil, India and Turkey have made significant progress in implementing carbon pricing mechanisms.

Progress has also been made at the subnational level, despite some setbacks. In addition, sector-specific multilateral initiatives for international aviation and shipping have made progress.

These developments indicate a growing global commitment to tackling climate change through economic incentives.

Despite a decade of strong growth, carbon prices remain inadequate. There is a notable implementation gap between countries’ commitments and the policies they have put in place.

Currently, carbon pricing tools cover about 24% of global emissions. While the consideration of new carbon taxes and emissions trading systems (ETS) could potentially increase this coverage to almost 30%, achieving this will require strong political commitment.

Over the past year, carbon tax rates have increased slightly; However, price changes within the ETS have been mixed, with ten systems seeing price declines, including the long-standing ETS in the European Union, New Zealand and the Republic of Korea. As a result, current price levels fall short of the ambition needed to achieve the goals of the Paris Agreement.

Carbon prices have reached new highs

In 2023, carbon pricing revenues reached new highs, surpassing $100 billion for the first time. This milestone was caused by high prices in the EU and a temporary shift of some German ETS revenues from 2022 to 2023.

ETS remained responsible for the majority of these revenues. It is striking that more than half of the revenue collected was spent on financing climate and nature-related programs. Despite these record revenues, the overall contribution of carbon pricing to national budgets remains low.

On the positive side, emerging flexible designs and approaches reflect the adaptability of carbon pricing to national circumstances.

Governments are increasingly using multiple carbon pricing tools in parallel to expand both coverage and price levels. While carbon pricing has traditionally been applied in the energy and industrial sectors, it is now increasingly being considered for other sectors such as maritime transport and waste management.

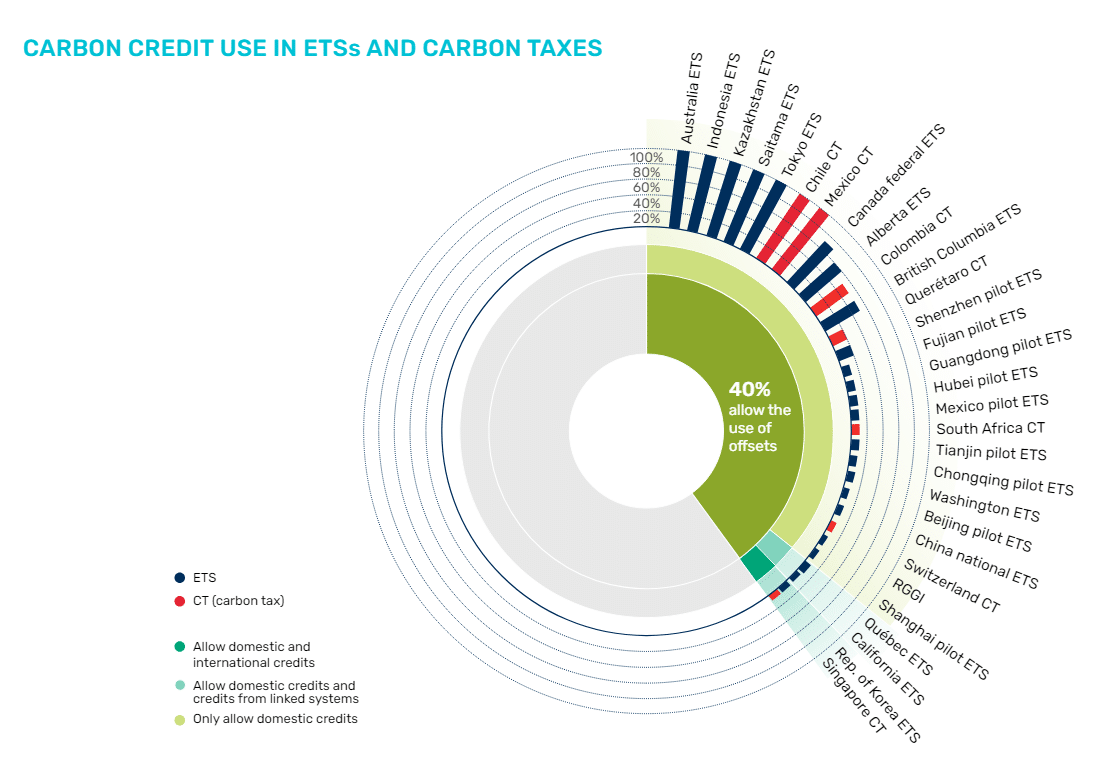

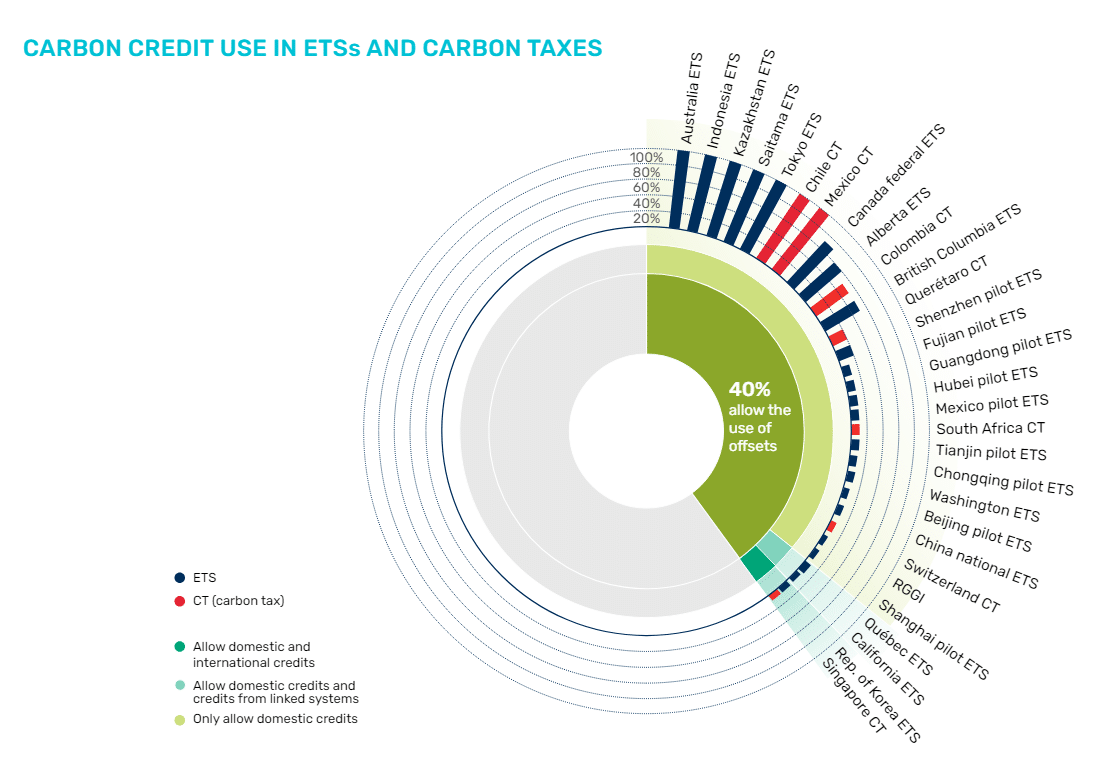

Additionally, governments continue to allow regulated entities to use carbon credits to offset carbon pricing obligations, increasing flexibility, reducing compliance costs and extending the carbon price signal to uncovered sectors. In addition to mitigation, carbon pricing also offers significant tax benefits, further demonstrating its multifaceted benefits.

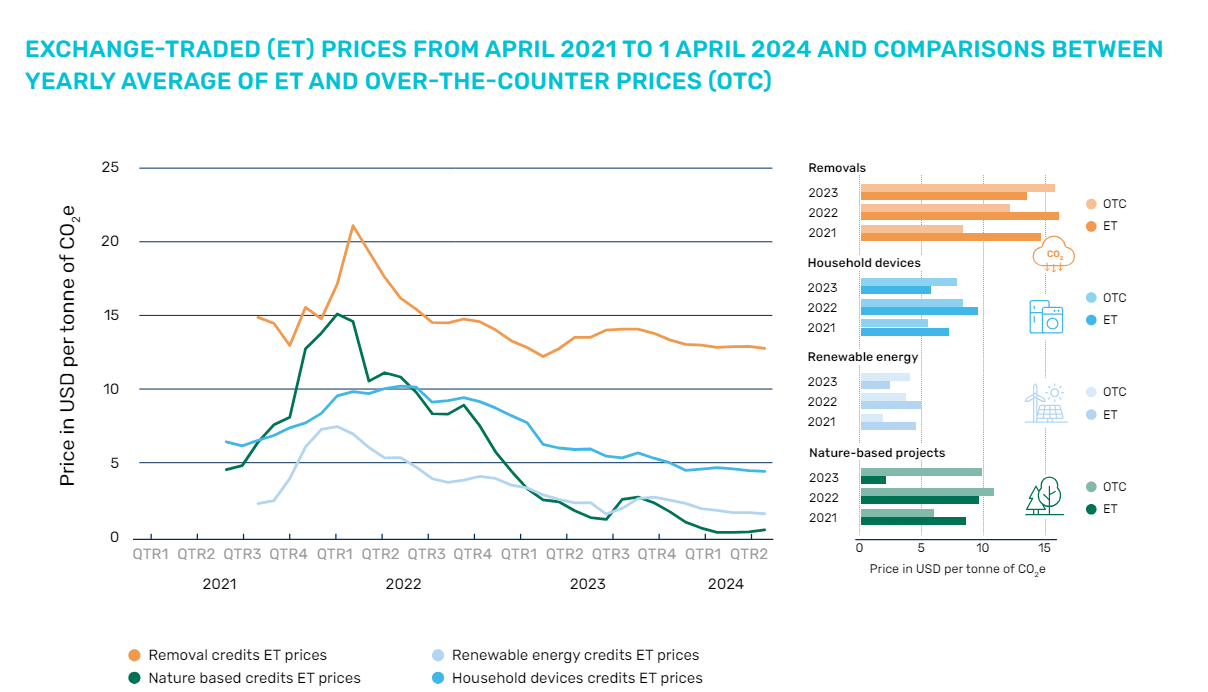

The carbon credit markets saw mixed moves: ET versus OTC

Governments, especially in middle-income countries, are increasingly incorporating credit frameworks into their policies to support both compliance and voluntary carbon markets. Despite this, credit issuance fell for the second consecutive year and pensions remained substantially lower than issuance, resulting in a growing pool of non-retiree credit in the market.

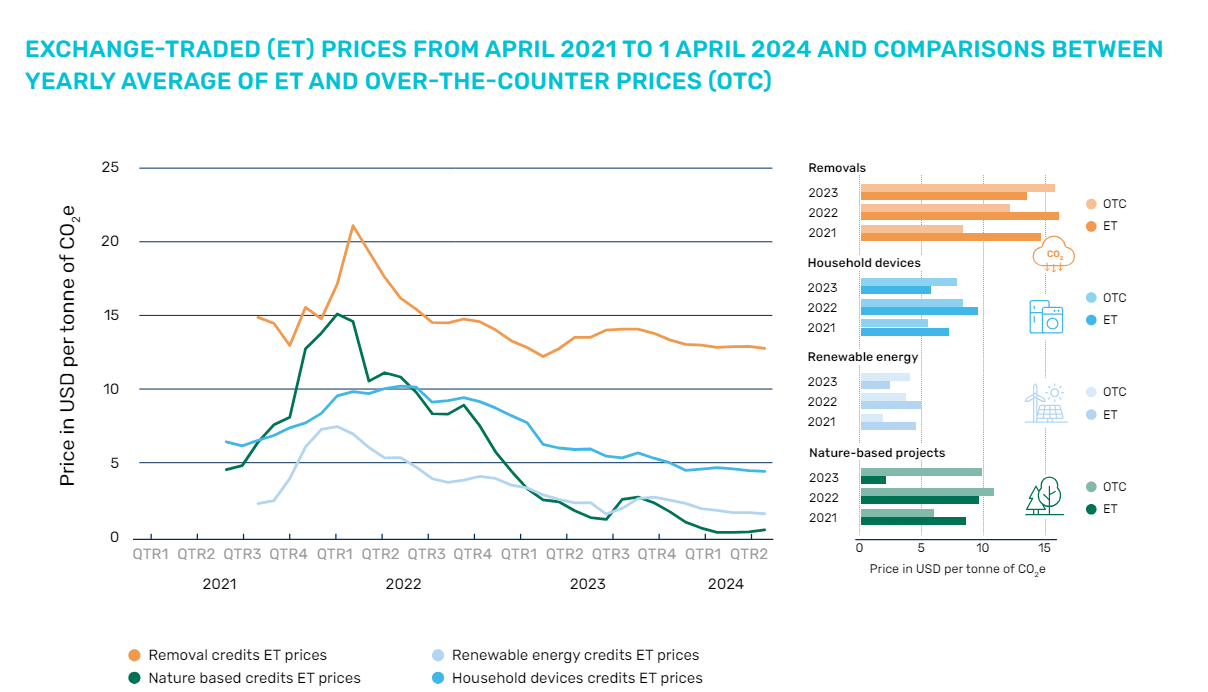

While demand for compliance increases, voluntary demand continues to dominate. Prices fell in most project categories, with the exception of carbon removal projects, where interest increased.

Prices also proved more resilient in over-the-counter transactions, where buyers can follow specific purchasing strategies. Credits with specific features (such as additional benefits, corresponding adjustments or recent vintages) traded at a premium, highlighting the additional value these features provide to buyers.

Restoring the Integrity of Carbon Credits

The subdued market and reduced confidence underline the importance of initiatives aimed at restoring the integrity and credibility of carbon credits. The integrity of these credits remains a key concern for the market.

To address this, the Integrity Council for the Voluntary Carbon Market has established a benchmark for credit quality, with the first tranche of approved credits expected in 2024. On the demand side, efforts are aimed at emphasizing the reduction of emissions from operations and the value chain. and exploring the potential role of carbon credits in addressing residual emissions.

Furthermore, the development and implementation of Article 6 of the Paris Agreement continues despite setbacks and delays. These efforts are essential to rebuilding trust and ensuring the effectiveness of carbon credit markets.