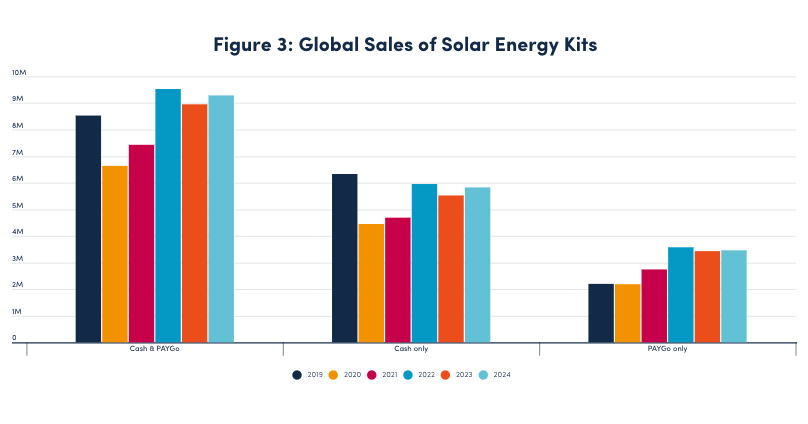

While the sale of off-grid solar packages has risen slightly in 2024, the market did not regain the momentum that was seen before 2022. The latest report of the professional association of industry, Gogla, contains data on solar tenderers for the first time (38,000 units sold in 2024) and walk -in cold rooms (578 units).

According to the Global Off-Grid Solar Market Report Annual Sales & Impact Data 2024, published on 26 May 2025, last year the global off-grid Solar Industry Association Gogla, 9.3 million solar kits were sold by grid-connected companies.

This slight increase compared to 2023 will be observed below the record level in 2022. This momentum has been mixed, although the demand remains strong in areas that are not connected to national schedules, especially in Africa, the Sahara with East Africa that drives the overall market in 2024.

More generally, the sector on a global scale does not seem to have recovered the momentum that before the crisis 2021-2022 it was seen when the more difficult access to financing complicated the development of the off-grid market. Nevertheless, Gogla emphasizes the resilience of the sector, in a context characterized by inflation and financial problems for the intended households.

An additional 20 million people benefited from the energy produced by a tanning network purchased in 2024, according to the estimates of the report, which brought the cumulative total to 138 million users since 2010 – without indicating whether these systems are still in operation.

Structural problems of pay-as-you-go

The majority of the kits sold depends on the pay-as-you-go (Paygo) model, with which households can acquire a solar system through payment payments for several months. This formula, presented as a solution for energy intake, has also attracted companies from other sectors (digital, telecom, etc.) to the energy market. However, it is based on the ability of households to make regular repayments, often in precarious economic contexts characterized by instability, inflation or irregular income. It is also confronted with a clear limitation: households have little room to increase their electricity spending, and off-grid solar energy often remains more expensive than conventional grid electricity.

Sales trends suggest a structural limitation for this model: when purchasing power drops or stagnates, even microcredits become inaccessible. For some observers, this raises questions about the long -term sustainability of a model based on the fault of the most vulnerable households.

Subsidies

Faced with this limitation, impact financing such as results -based financing (RBF) is increasingly emerging as a necessity, and not just a one -off lever for the sector. In concrete terms, companies can lower their royalties in the case of a decrease in turnover, and vice versa, the amounts to be paid in proportion to the generated income. Sarah Malm, executive director of Gogla, emphasizes the importance of these subsidies for the sector and claims that “there is an urgent need for more clarity and long -term stability in the implementation of these schemes.” Subsidies help reduce the final costs for users without endangering the profitability of operators (although the money paid is still financed by taxpayers). However, they require a structural use of donors and public policy, which is often difficult to guarantee.

The report also emphasizes that international donors play a crucial role in structuring this financing, which requires long -term obligations that are often difficult to maintain. In 2024, a joint initiative between the World Bank and the African Development Bank – by 2030 when exciting 300 million people – could pave the way for new subsidy schemes for solar kits and related devices. The C&I sector in Focus

The report also contains data on two types of equipment intended for productive use: solar generators (38,000 sold units) and walk-in sun-cold rooms (578 units) in 2024. These devices, mainly used in commercial or agricultural activities, reproduce a gradual expansion of the resident (commercial and industrial), that less dependent on the dependent and industry For local economies.

In Africa, these applications include the preservation of crops, cooling in rural -cold chains and delivering small companies or workshops – sectors considered strategically by many stakeholders. Finally, the association calls for an increased mobilization of companies to provide future editions of the report with more extensive sales data, to better guide public policy and financing.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.