In a new weekly update for PV -MagazineOpis, a Dow Jones company, FOB China Topcon under 450 W modules for spot load were stable at $ 0.093/W, with price indications between $ 0.087-0.100/W. Moreover, it reveals that the current price increases are not accepted uniform in all Chinese manufacturers, with significant price differences – often different eurocents – observed between the top 5 and top 10 manufacturers.

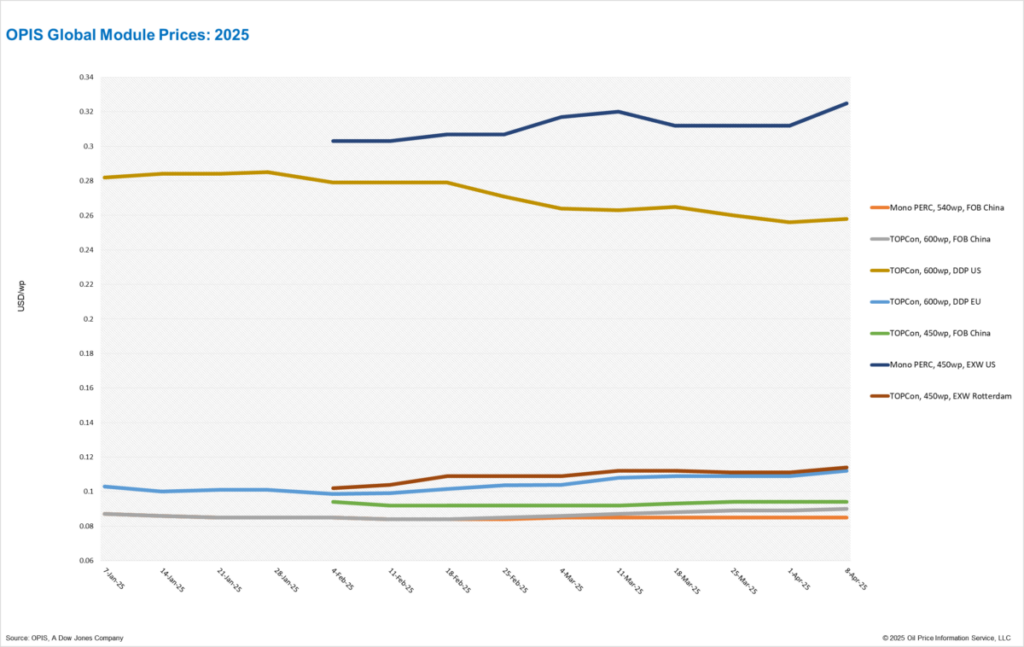

China: The Chinese Modulemarker (CMM), the Opis Benchmark Assessment for SpotconCon modules of more than 600 W from China rose 1.12% to $ 0.090/W. Free-on-board (FOB) China, with price indications between $ 0.085-0.094/WP. FOB China Mono Perc module price was stable at $ 0.085/W with indications between $ 0.082-0.088/W.

In the forward market, the Q2 2025 charging loads were rated at $ 0.089/W, while the price of Q3 2025 was flat at $ 0.086/WP. Prices for Q4 2025 and Q1 2026 kept stable at $ 0.086/W and $ 0.085/W respectively. Q2 2026 The charging prices remained unchanged at $ 0.085/W, with offers ranging from $ 0.080/W to $ 0.090/W.

FOB China Topcon Under 450 W modules for spot load were stable at $ 0.093/W, with price indications between $ 0.087-0.100/W.

Strong short-term demand-driven by the installation football before the 430 and 531 policy of China–has encouraged the leading manufacturers to increase their production for April by a maximum of 3 GW, so that the total output pushed to the low to middle 50 GW range. Various top 10 producers have raised their offers by CNY 0.01 ($ 0.0014)/W and CNY 0.02/W. According to trade sources, rising costs of electricity components such as glass, waffles and cells have also played a role in the price increases.

Nevertheless, market participants expect an increasing price pressure during mid -April as the purchasing activity peaks. Various manufacturers have also expressed concern about a possible competitive correction in module prices in May or June, after the implementation of relevant policy. As noted by a leading producer, the outlook for persistent module price increases in the second half of 2025 seems weak, given the expected decrease in demand.

Europe: DDP Europe prices for topcon modules of more than 600 W rose 0.99% a week to € 0.102 ($ 0.115)/W, with market indications ranging from € 0.096/W to € 0.112/W for Tier-1 panels.

Likewise, EXW Europe prices for topcon modules under 450 W rose with 0.97%, rated at € 0.104/W, with reported indications ranging from € 0.097/W to € 0.115/W for Tier-1 panels.

Market sources agree that the prices of the modules can rise to mid -2025, after which they are expected to stabilize within the reach of € 0.110/W to € 0.120/W. A return to the start of the start of the year of € 0.080/W is considered unlikely.

The current price increases are not hired uniformly among all Chinese manufacturers, says sources. Significant price differences – often different cents – are observed between the top 5 and top 10 manufacturers, largely influenced by factors such as liquidity and stock levels.

On the supply side, delivery times for large producers are reportedly tightening and securing inventory becomes more difficult in the midst of a stricter delivery than last year. Reportedly, most shipments are sold in transport and rarely reach warehouse boards.

US: The spot price for Topcon above 600 W DDP US was rated this week at $ 0.258/W, an increase of 0.78% compared to last week, while the spot price for Mono Perc modules under 450 W Exw increased by 4.17% to $ 0.325/W.

On a future-oriented basis, OPIS assesses the costs of Topcon modules in the first quarter of 2026 at $ 0.276/W, and Mono Perc modules in the same period at $ 0.266/W.

The market remains the implications of the recent announcement of President Trump of ‘mutual’ rates, which the Southeast -Asian countries have considerably affected considerable capacities for solar energy. It is remarkable that new rates include 48% for Laos, 32% for Indonesia and 26% for India.

Larger price increases are expected to look forward as the rates come into force. A source established in the US noted that the module prices for input from Southeast Asia can rise by around $ 0.05/W in the short term, so that the American modules may be priced more competitively.

Market participants report that the import volumes of module in the US have risen in recent months because buyers have goods in stock of the tariff role. For shipments not yet sent, suppliers are reportedly negotiations with buyers to revise existing agreements and to share the extra tariff burden. One source revealed a request for their customer to pay an extra $ 0.06/wp on top of the previously agreed price.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content