The carbon sector is still in its early stages, but there are already a number of different products available on the market.

If you’ve spent much time in the carbon credits field, you may have come across the terms GEO, N-GEO, and C-GEO before.

These products have been around for a while but, like much of the carbon sector, have flown under the radar of most investors.

If you don’t know what they are, or if you do but don’t really know the difference between them, read on.

Compensation vs. Compensation Credits

You’re probably already aware of European Union Emissions Allowances (EUAs) and California Carbon Allowances (CCAs).

These carbon credits are allowances from their respective compliance regimes in the European Union and the US state of California, respectively.

Essentially, they allow their holders to emit a corresponding amount of carbon equivalent pollution every year. Another example of these types of rights are the rights of the Regional Greenhouse Gas Initiative (RGGI).

These emission allowances are tradable and a secondary futures market has also emerged around them. These carbon rights futures are what many of the largest carbon funds, such as KRBN, own.

GEO, N-GEO and C-GEO are similar to those future plans for carbon rights, but there is one big difference.

The big difference is that the GEO product line, instead of being based on market-based emission allowances, is based on voluntary CO2 offsets on the market.

It’s even in their name: GEO stands for Global Emissions Offset.

There are the CBL Global Emissions Offset (GEO), the CBL Nature-Based Global Emissions Offset (N-GEO) and the CBL Core Global Emissions Offset (C-GEO) contracts. These are the three types of offset contracts referred to when GEO, N-GEO and C-GEO are mentioned.

These three offsets were launched by the Chicago Mercantile Exchange (CME Group), the world’s largest derivatives marketplace, to respond to the growing demand for carbon offset products in the carbon sector.

Just as there is a difference between the EUA, CCA and RGGI futures, there is also a difference between the GEO, N-GEO and C-GEO offset futures.

However, it’s not that simple as they are all simply based in a different location, so we’ll discuss the main differences next.

We start with the first product, which was launched at the end of 2020: GEO.

GEO (carbon offset for the aviation industry)

GEO’s futures contracts are based on carbon offsets from three major registries: Verra, the American Carbon Registry and the Climate Action Reserve. Technology-based projects (i.e. projects not falling into the Agriculture, Forestry or Other Land Use categories) that follow the International Civil Aviation Organization’s CORSIA standard can be found here.

To put it more simply, GEO futures contracts are based on high-quality carbon credits that meet the international aviation industry standard for emissions offsets. This is why they are sometimes referred to as “airline industry carbon offsets.”

Although the CORSIA standard was originally intended for use by the aviation industry, GEO contracts are by no means limited to just airlines and other companies in the aviation industry.

CORSIA is a rigorous framework that has been carefully developed over several years under the guidance of the United Nations. Therefore, compensations that meet CORSIA criteria are verifiable and of high quality. This makes them an excellent choice for any company or individual looking for a tangible means of offsetting their emissions.

N-GEO (nature-based carbon offset)

After GEO we have N-GEO, which launched just a few months after the first.

N-GEO consists of nature-based offset projects from the Verra Register – projects that fall under the Agriculture, Forestry or Other Land Use (AFOLU) categories. This is in contrast to GEO, where there are no AFOLU projects.

Nature-based solutions have many advantages and disadvantages compared to technology-based compensation projects. For example, they can make a valuable contribution to biodiversity, but it is also often considered more difficult to accurately verify the amount of carbon that is actually offset in nature-based projects.

As a result, N-GEO covers a large part of the offset market that is not covered by GEO. This offers more opportunities for companies that want to reduce their own emissions, especially companies that themselves belong to the AFOLU sector.

C-GEO (Technology-Based Carbon Offsetting)

Last but not least is C-GEO, which was launched in early 2022. The C in C-GEO stands for Core, which refers to the Core Carbon Principles (CCPs) of the Taskforce on Scaling Voluntary Carbon Markets.

The CCPs are the foundation laid by the Taskforce on Scaling Voluntary Carbon Markets for creating a global, large-scale carbon credit market. C-GEO contracts consist of technology-based, non-AFOLU offset projects from the Verra registry that align with the CCPs.

Although first established in January 2021, the CCPs are a work in progress and are being further refined by an independent governing body made up of a number of climate action representatives, advisors and institutions. Further expansions of the CCPs are expected, launched in phases through 2022.

As such, C-GEO contracts are still in their infancy. However, it is entirely possible that the CCPs will become the new unifying global standard for offset projects, given the amount of expertise and influence supporting this standard.

That makes C-GEO futures an excellent choice for companies looking for high-quality, technology-based offset credits and who also want to rely on the future of the Core Carbon Principles.

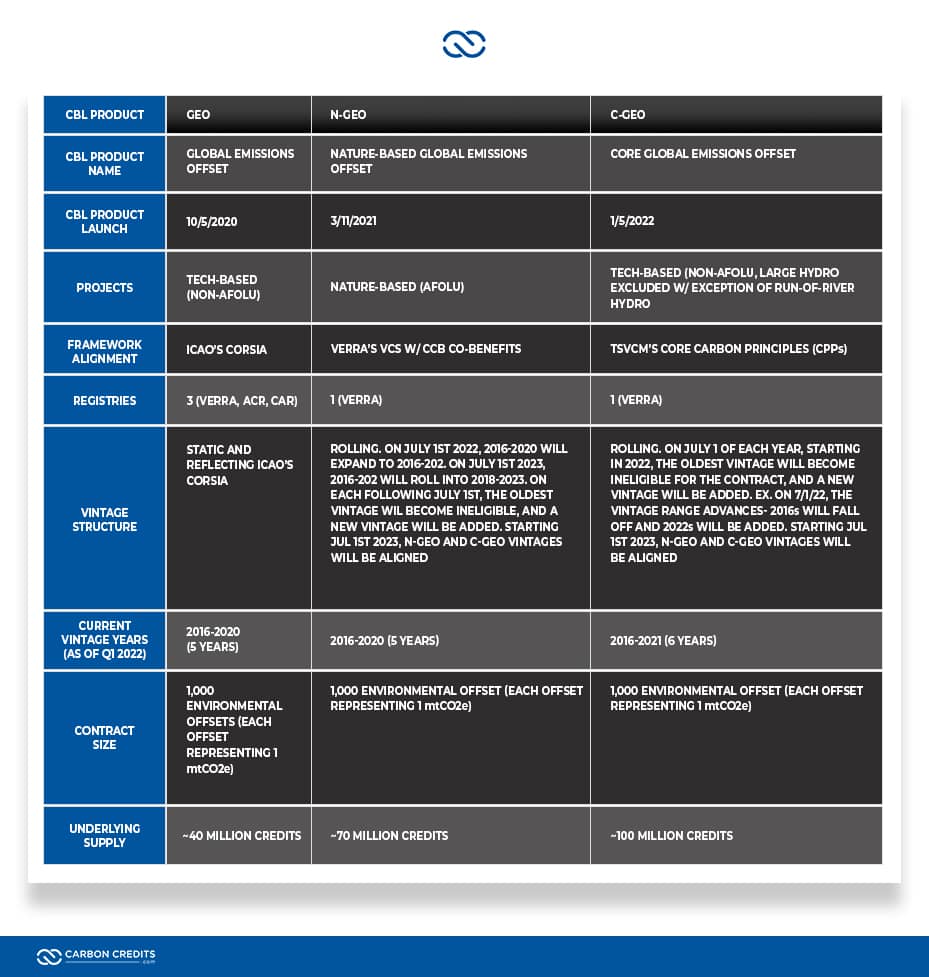

Below you will find a table of the CME Group a summary of the main differences between GEO, N-GEO and C-GEO: