In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

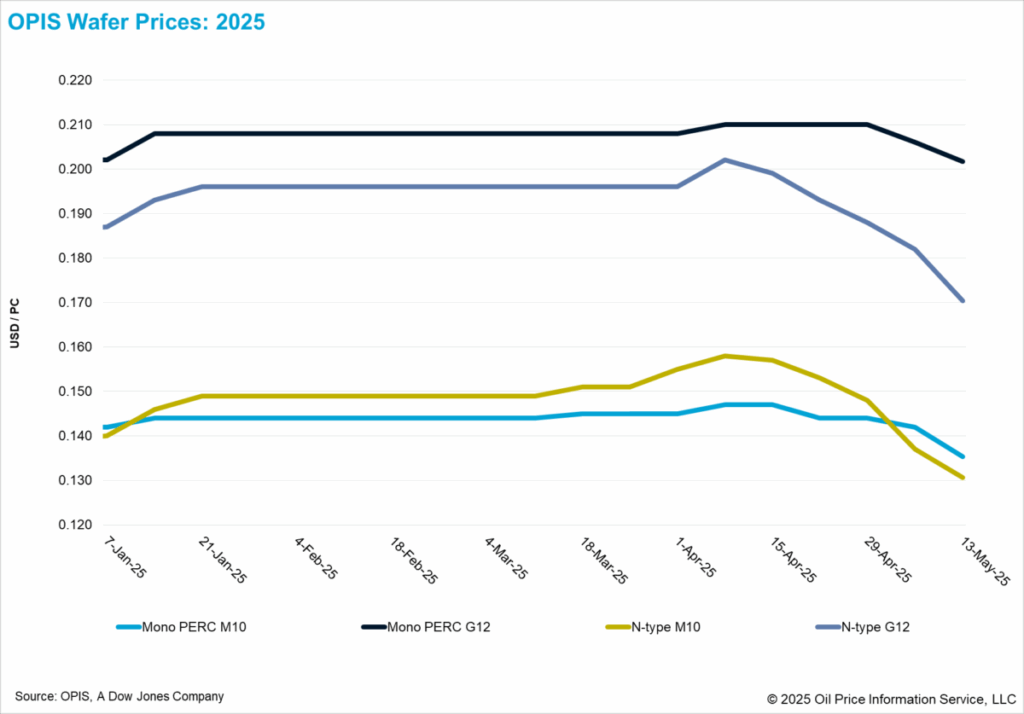

FOB China Wafer prizes saw wide falls this week. Mono Perc M10 and G12 waffle prices fell to $ 0.135/PC (per item) and $ 0.202/PC, which represents drops of 4.93% and 1.94% a week on week on a week on a week. Similarly, the N-type M10 and G12 wafer prices fell to $ 0.131/PC and $ 0.170/PC, 4.38% and 6.59% compared to the last week.

The remarkable decrease in the wafers is largely powered by weakening the electricity demand after a recent peak. Market sources indicate that producers of both solar cells and module are planning to lower the company rates from May, allegedly follow manufacturers of Wafers.

According to insiders, specialized waffle manufacturers maintain relatively higher usage percentages, whereby a leading player is reportedly working with around 80% capacity. Integrated manufacturers, on the other hand, have reduced their use to around 55%, while smaller producers of the second and third row, limited by limited capacity and outdated equipment, work with only 20%to 30%.

Although the current WAFER inventories remain manageable, the weakening of demand in combination with persistent overcapacity has increased the risk of inventory accumulation. In response, some wafers manufacturers started lowering prices and sacrifice profit margins in an attempt to stimulate sale, according to trade sources. The prevailing transaction price for mainstream N-type M10 and 182*183 mm waffles on the Chinese market are reportedly fluctuated around CNY 1 ($ 0.14)/PC, with certain 182*183 mm waffles that are already traded under this threshold. Sources from the industry report that some celf manufacturers insist on a maximum wafer purchase price of CNY 1/PC.

There are concerns about the future profitability of waf manufacturers. One market observer noted that, under ideal circumstances-filled production capacity and access to N-type polysilicon priced under CNY 30/kg-the cash production costs for N-type M10 waffles could be limited to approximately CNY 1/PC. With the current N-type polysilicium prices that remain in the higher range of CNY 30/kg to CNY 40/KG, and the production lines of the Wafer that work under optimum levels, financial losses in the sector are becoming increasingly clear.

Looking ahead, widespread pessimism around the market demand in 2025 is the Bearish sentiment with regard to the profitability prospects for Chinese waffle producers. Insiders from the industry point out that, due to the enormous capacity of the sector and high operational flexibility, every meaningful capacity reduction will probably be a long -term process. In the meantime, the possibility to maintain sufficient cash flow will be crucial to determine whether companies can withstand in the long term.

Operational trends among waffle manufacturers outside of China show mixed developments on the global market. A Southeast Asian waffle producer with an estimated capacity of 6 GW reportedly increases its business speed from less than 50% to more than 70% in May, powered by the rapid expansion of cell production facilities in Indonesia. Another Southeast Asian waffle manufacturer of comparable capacity, on the other hand, would maintain a relatively low use of around 30%.

In the meantime, a company that has announced large-scale wafer production plans in the Middle East is reportedly prepared for the construction of construction in the first or second quarter of next year. A source that is familiar with the case, however, noted that the company still assesses the economic feasibility of the project, which increases the possibility of further delays.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content