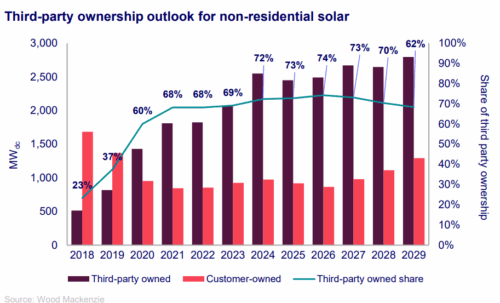

Owner of third parties (TPO) of non-residential projects in the United States rose to 72% market share in 2024, an increase of 69% in 2023, according to the latter “US Commercial Solar Competitive Landscape” report From Wood Mackenzie.

The report projects the TPO segment will continue to lead to commercial and community soning financing, with a market share of 74%by 2026 before they moderate to 62%before 2029. According to Wood Mackenzie, Nexamp held the largest TPO market share in 2024 (7%), followed by Summit Ridge Energy (6.5%) and standard Solar (5.3%).

The report projects the TPO segment will continue to lead to commercial and community soning financing, with a market share of 74%by 2026 before they moderate to 62%before 2029. According to Wood Mackenzie, Nexamp held the largest TPO market share in 2024 (7%), followed by Summit Ridge Energy (6.5%) and standard Solar (5.3%).

“The maturation of the market for transferability of tax credit stimulates the growth of ownership of third parties,” said Amanda Colombo, research assistant at Wood Mackenzie. “Transferable tax credits offer less complex, cheaper and more flexible monetization options for TPO projects. Small and medium-sized project developers report that transferability has simplified the financing of third parties.”

Credit: Nexamp

The report also showed that the total American commercial solar market set a new annual record in 2024, with 2.1 GWDC of new capacity that has been installed nationally. Important states such as California, Maine and Illinois have contributed to the growth of 8% on an annual basis.

Looking ahead, Wood Mackenzie predicts that more than 11 GWDC New commercial solar capacity will be added in the United States for the next five years. Rising electricity prices, growth in emerging markets and continuous momentum of the inflation reduction Act is expected to be important factors of installation growth.

“Emerging markets for solar energy throughout the country experience an increase in installations, driven by favorable factors such as low development costs, untouched solar potential and abundantly available country,” Colombo said. “In particular, less established markets in the Midwest and Southeast regions witness a significant growth of commercial solar deployment.”

News item from Woodmac