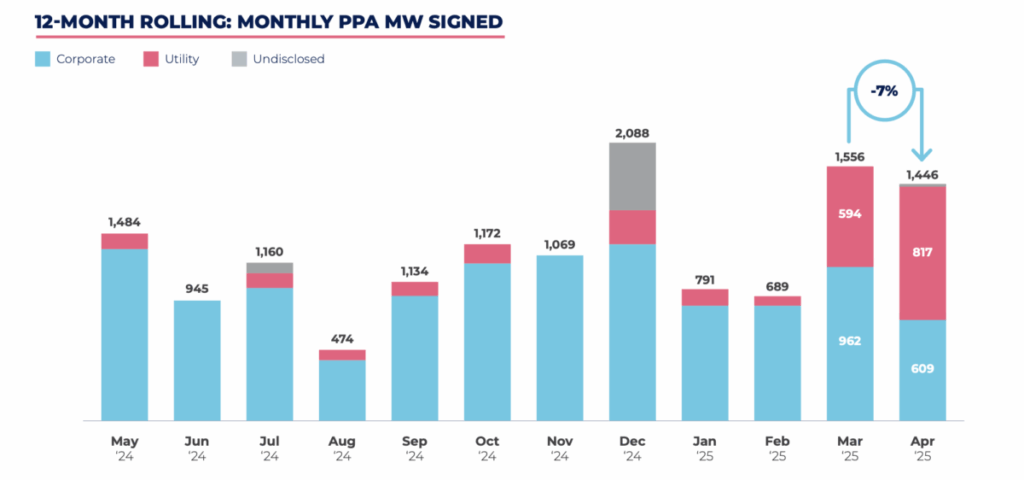

European developers signed 22 PPAs a total of 1,446 MW in April, according to the latest report from the Swiss research agency Pexapark.

Pexapark said that April managed to continue with ‘the momentum of relatively high volumes’, just a little behind the results of March.

PPA volumes of utilities exceeded companies PPAs for the first time in many years, adds Pexapark’s analysis, accounting for 57% (817 MW) of the total public volumes over eight deals.

Solar was good for more than half of the capacity signed last month, a total of 759 MW in 10 deals.

The majority of this solar capacity is treated in the largest deal of the month, a PPA Intra group in Greece, where Meton Energy, a joint venture between RWE and PPC-Renewable energy sources, a 10-year PPA signed with PPC and RWE delivery and trade for the output Solar Solar. The second and third largest deals of the month were both wind PPAs.

Pexapark noted that the PPA prices followed fell 1.6% month on a month and settled at € 48.80 ($ 55.32)/MWH. For the second consecutive month, Poland registered the steepest fall, with PPA reference prices with 6.8%. PPA prices also fell in the British, Dutch, French, German, Italian and Portuguese markets.

The Nordic and Spanish markets have covered the trend, with PPA prices that rise by 7.5% and 2.5% respectively. In the case of the Nordics, Pexapark says that the increase in fluctuations followed in future energy prices, mainly influenced by shifts in the hydrological balance.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content