The latest report of the technical compliance and quality assurance company added various new producers, but also noticed ACORS in various factory closures in the region. It said that the current type plate capacity for the 21 GW region stands for modules, 3.2 GW for cells and 1.5 GW for ingots.

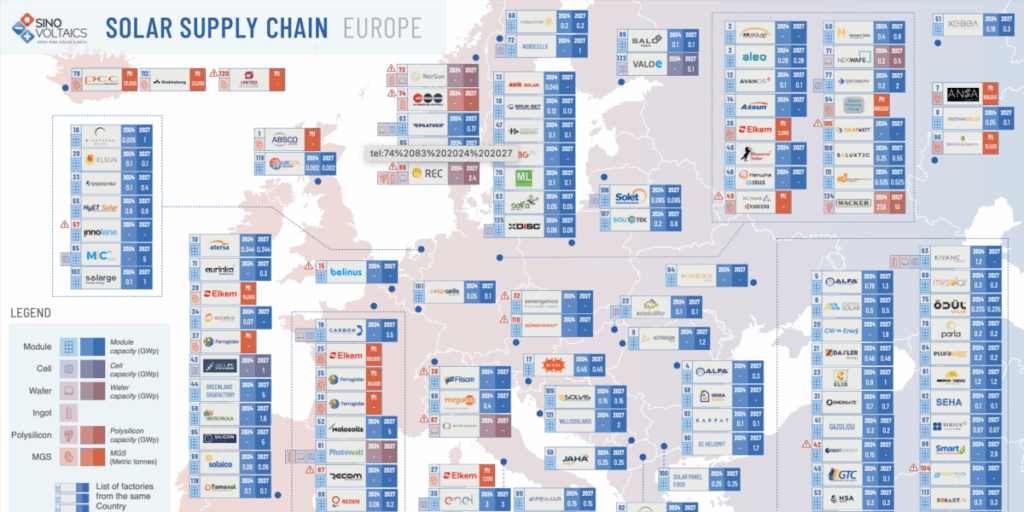

Sinovoltaics, a technical compliance and quality assurance company established in Hong Kong, has released its latest PV module Supply Chain card for Europe and Turkey, plus Egypt and Kazakhstan. The report follows the announced factory location, size, owner and planned capacity, as well as sites that are closed or where the capacity is on hold.

125 factory sites are listed in the Sinovoltaics Europe Solar Supply Chain Map for 1Q2025, that is available as a free download. It follows locations that produce PV modules, cells, waffles, ingots, polysilicon and metallurgical quality silicon, mainly based on public announcements.

The Sinovoltaics analysts describe the landscape of solar production as challenging. “Although the clean industrial deal of the European Union promises to stimulate domestic PV production, the region is currently struggling with a wave of bankruptcies and factory closures,” said it.

On the one hand, they noticed additions, such as KIVANC SOLAR, that 1.2 GW module production and 5 GW of cell production in Turkey, SC Heliomat strives for 1.5 GW in Romania, Elite Solar Planning 8 GW in Egypt, and in Turkey Energy of 300 MW capacity.

On the other hand, the status of Photowatt, Systovi, Remom Silia and Solarwatt was changed to reflect plant closures or decisions for the reductions of the production site. They also noticed a few bankruptcies in Turkey, Belgium and the Netherlands.

As for further upstream, the analysts emphasized that Meyer Burger continued 500 MW of cell production, but no modules, while various polysilicium and ingot facilities were closed in Norway.

“Currently, the combined capacity of the region is 21 GW for modules, 3.2 GW for cells and 1.5 GW for INGOTS,” said the analysts, adding that an additional 70 GW in modules, 55 GW in cells and 24 GW could be added by 2030 on the basis of announcements.

Sinovoltaics warns that shifts can introduce quality problems in the supply chain. “We see that capacity just no longer guarantees resilience. Transparency and verified production performance are just as critical,” said Dricus de Rooij, CEO of Sinovoltaics.

The Solar Supply Chain series includes maps of the production hubs in India, Southeast Asia and North -America. There is also an annual production map for transformer for mainland China.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.