In a new weekly update for PV -MagazineOpis, a Dow Jones company, offers a quick look at the most important trends in the global PV industry.

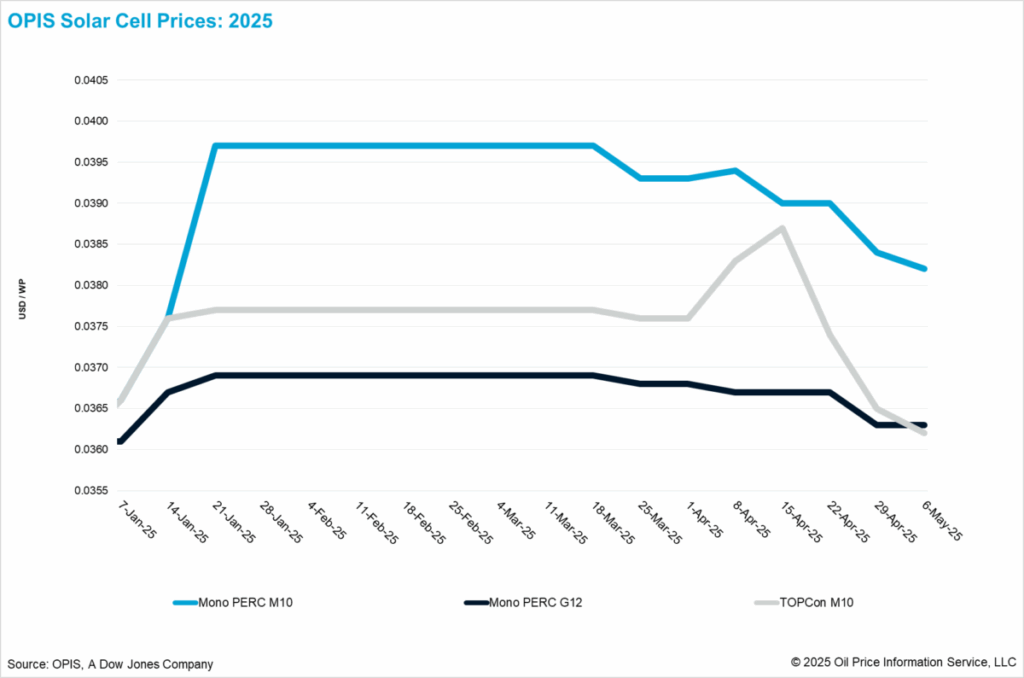

FOB China cell prices fell in the middle of weaker market fundamentals this week, according to the OPIS Solar Weekly report. Topcon M10 -cell prices decreased 0.82% week on week to $ 0.0362/W, while mono perc m10 cells 0.52% decreased to $ 0.0382/W. Mono Perc G12 -cell prices kept stable at $ 0.0363/w.

Price indications for China Interior Topcon M10 cell price on average at CNY 0.282 ($ 0.039)/W, with indications between CNY 0.270/W and CNY 0.300/W. Domestic Mono Perc M10 cell prices were between CNY 0.290/W and CNY 0.310/W with an average of CNY 0.300/W, while mono Perc G12 prices average CNA 0.285/W, with a range of CNY 0.280/W to CNY 0.290/W.

Topcon cell prices fell for the third consecutive week, weighed by a subdued requirement of the end user in the midst of the implementation of the 430 policy in China and recent softness in both wafer and module prices. Industrial sources expect that the demand for end user will be subjected in the short term, after a period of front-load module installations in the past two months, during which the production levels of the Chinese cell remained increased.

According to an OPIS survey, the Chinese cell production was high from March to April, with leading manufacturers with a use of more than 70% operating, while producers of the second and third row of levels maintained around 50%. However, the prospects for May have deteriorated. Top manufacturers are expected to reduce the user percentages to less than 60%, while smaller players under 30%can fall. In accordance with these trends, sources report that the expected production has been revised from 64 GW in April to around 58 GW in May, with further cutbacks probably in the midst of further electric weakness.

Looking ahead, sources from the industry suggest that price trends can vary on different N-type cell specifications. Chinese cell producers are reportedly shifting their focus on promoting Topcon 210R (182*210 mm) cells, a movement that could increase the offer and put extra downward pressure on prices for this specification.

Although Opis has not yet started assessing the FOB China price for these cells – because of their limited acceptance in the foreign market – sources from the industry indicate that domestic production of this format has already recorded more than 30% market share in China. According to trade information, the regular domestic price for Topcon 210R cells is approximately CNY 0.265/W from this week, which marks a remarkable decrease from approximately CNY 0.310/W a month earlier.

On the other hand, the supply of Topcon M10 cells can become tighter due to reduced production levels, which suggests that the price fall for this specification could be more moderate in the short term.

Outside of China, in addition to the progress of domestic cell production in the US, worldwide strategies for cell production are increasingly focused on gaining low or tariff -free access to the American market. Malaysia, Laos and Indonesia have settled as important production hubs, whereby the output is also expected to grow in India and South Korea.

Moreover, Ethiopia recently emerged as a new production site, while the Midden -Oost is expected to develop into another remarkable production basis from the second half of the year.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content