A new report from BeZero Carbon, a carbon assessment company, reveals that a $100 billion carbon market could protect 150 million hectares of land, equivalent to the size of Peru, and spur annual investments of $700 billion in carbon projects.

The report, “$100 billion for Planet and People”, highlights the potential environmental and economic benefits of a global carbon market of this size. BeZero also estimates that such a market could support 12.4 million jobs in forestry, nearly 3 million in sustainable agriculture, 310,000 in renewables and 50,000 in adjacent industries.

Tommy Ricketts, CEO and co-founder of BeZero Carbon, stated:

“A $100 billion project-based carbon market would deliver enormous benefits for the planet and people. It means companies spending billions on new technologies and land restoration, supporting more jobs than the oil and gas sector, while shrinking our global footprint.”

From forests to agricultural lands: various activities that generate carbon credits

Today, more than 50 types of activities generate carbon credits, ranging from forestry and mangroves to methane capture and soil carbon sequestration. And the number is steadily increasing.

Each carbon credit represents one tonne of carbon dioxide or other greenhouse gas equivalent (CO2e), which is mitigated by a specific activity over a specified period of time.

This growing range of carbon credit generating activities highlights the multifaceted approaches available to combat climate change. It underlines the growing importance of the voluntary carbon market (VCM) in global efforts to reduce emissions.

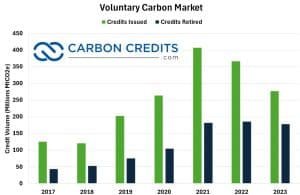

The market has seen tremendous growth in 2021, but concerns over the integrity of carbon credits impacted the market. Issuance has fallen in two consecutive years, as shown in the chart below.

Still, forecasts are positive for VCM growth as the world strives to mitigate climate change and reduce carbon emissions.

BloombergNEF predicts that the global carbon market will surpass $100 billion by the mid-2030s. The analyst also estimated that credit demand would reach 2.5 billion per year at an average price of $40.

How a $100 billion market drives emissions reductions

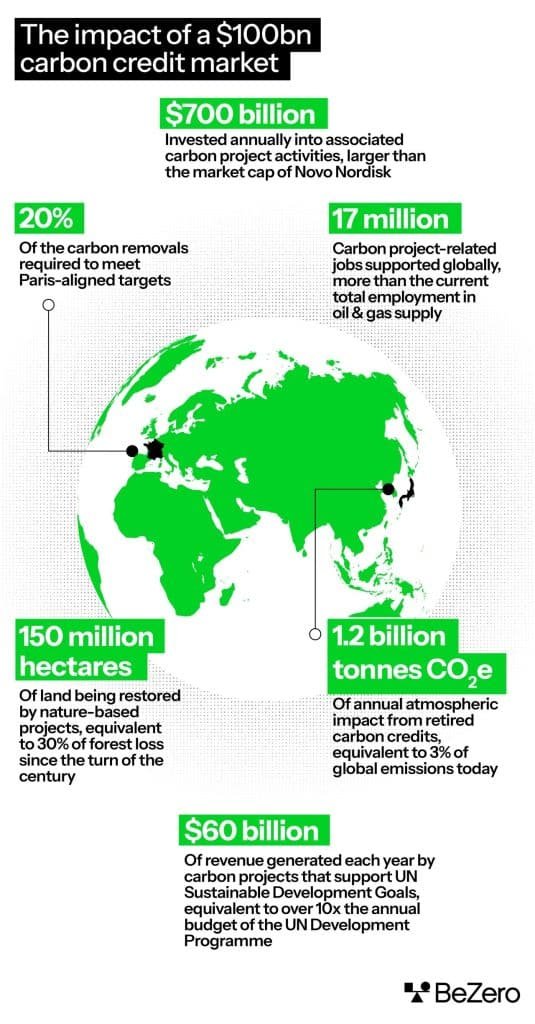

The report offered several relevant insights into what the $100 billion carbon credit market could offer. Here are some key findings that the entire industry should know.

- A $100 billion carbon credit market in the mid-2030s could finance emissions removal projects 20% of carbon removal necessary for a range of 1.5 degrees Celsius, according to the Paris Agreement. Such a market would focus on projects such as reforestation, Direct Air Capture (DAC) and Bioenergy with Carbon Capture and Storage (BECCS).

- The market could steer $700 billion in annual investments in carbon projects, a ratio of 7:1. Carbon credit revenues make these projects viable and unlock essential institutional capital, especially for technologies that require significant initial and operational investments, such as DAC. Without carbon credits, these projects would struggle to attract the necessary financing to effectively reduce and remove carbon emissions.

- The report suggests that in a $100 billion market, retired carbon credits will approximately decline or disappear 1.2 billion tons of CO2e emissions per year. This represents a significant environmental impact, equivalent to approximately 3% of current global emissions. This is equal to Japan’s annual emissions and one and a half times those of the entire global aviation industry.

- The $100 billion carbon credit market could finance nature-based projects covering around $100 billion 150 million hectares, equivalent to 30% of global forest loss since 2000 and greater than Peru. These projects, such as afforestation in Brazil, blue carbon in Indonesia and soil carbon initiatives in the US, support endangered species, protect coastal areas and improve soil health.

By preserving and rebuilding diverse ecosystems, carbon credits contribute significantly to global environmental sustainability and biodiversity.

Furthermore, these credits, based on conservative risk adjustments, provide real emissions reductions and removals. As such, this underlines their role in mitigating climate change by effectively offsetting significant amounts of greenhouse gases from various sectors.

Clearing the path to expansion

But achieving a $100 billion market will require rapid expansion, addressing recent issues with carbon credit projects and improving verification and certification services. The report calls for integrating voluntary carbon credits into compliance markets, clear regulatory definitions and operationalizing international carbon markets under Article 6 of the Paris Agreement.

The Science Based Targets Initiative (SBTI) is considering allowing carbon credits for companies’ Scope 3 emissions, potentially impacting six gigatons of CO2e. If approved, this could value the global carbon market at $100 billion per year.

The report also urges companies to adopt internal carbon pricing and project developers to improve high-quality project delivery.

While proponents believe this approach could boost investment in carbon removal projects, critics worry it could undermine the integrity of science-based targets and reduce pressure on companies to reduce supply chain emissions.

The potential of a $100 billion carbon credit market extends far beyond economic benefits. By protecting 150 million hectares of land and creating millions of jobs in various sectors, such a market could achieve substantial environmental and social progress. Addressing verification and certification challenges, integrating carbon credits into compliance markets, and improving high-quality project delivery are critical steps toward realizing this vision.