The European Hydrogen Bank (EHB) concluded her Second green hydrogen auction Two weeks ago, selecting 15 renewable hydrogen production projects for public financing in the European Economic Area (EEA) and the granting of € 992 million in subsidies selected.

The selected projects secured feed-in premium rates ranging from € 0.20/kg to € 1.88/kg levels Some observers who were assessed as very low and doubted the viability of the projects. The rate is paid per kilogram produced hydrogen. Developers must find off -takers independent, with the Premium rate added to the hydrogen market price, which currently exceeds more than € 5/kg in Europe.

The figures from the European Commission show that the auction was four times surplus, with 61 bids being received in 11 countries and asked a total of € 4.88 billion.

EU quota

“The winning bids arrived at about the level we expected. They were similar to the pilot auction last year, albeit with a slightly wider spread that is understandable in view of the fact that this auction attracted fewer bidders than the pilot, ”said Wood Mackenzie -Hydrogen analyst Mark Thomton against PV -MagazineReferring to the first EHB auction in May 2024, which awarded almost € 720 million to seven projects in Finland, Norway, Portugal and Spain, with definitive bids ranging from € 0.37/kg to € 0.48/kg. “We were not surprised by this level across the winning bids. The auction was highly competitive and following the results of the pilot auction, developers will have been aware that the clearing price was likely to come in below €2/kg. One potential reason for the low prices may have been developers bidding at a Level They Feel Gives them a Chance of Securing a Subsidy Instead of Bidding at a Level They Need to Guarantee Project Viability – Which Means Something is Better Than Nothing. ”

According to Bloombergnef analyst Martin Tengler, the selected developers were able to submit very low bids because the European Union has binding quotas to use green hydrogen from 2030.

“The so-called Red III quotas are prepared to buy green hydrogen,” he said PV -Magazine. “They impose that 42% of European hydrogen comes from the green hydrogen by 2030. This stimulates buyers in certain EU member states to look at these new projects, although gray hydrogen is less expensive.”

However, the Member States still have to implement this quota at national level.

“Although the deadline to do this was 21 May, only a minority of the Member States has done it so far,” Tengler explained. “The difference between the newest and the first auction is that we have three winning projects from these two countries, which have higher hydrogen production costs compared to Spain. This was only made possible by the Red III quotas, which were passed on between the first and the second auction and are invested in Germany.”

Tengler said the certainty that the selected projects will discover that buyers have increased, but they probably do not have binding similarities yet.

“These buyers will be existing users of gray hydrogen, such as fertilizer or ammonia producers, and refineries, as well as maritime and aviation companies,” he said.

Feasibility

Thomton said that the level of hydrogen (LCOH) can vary greatly for selected projects, depending on factors such as location, strategies for energy treatment, optimization and equipment purchasing.

“An unknown Spanish offer reported an LCOH of € 3.1/kg that is very competitive but feasible for very well -designed projects,” he noticed. “But in general, these subsidy levels will not yield a cost parity with gray hydrogen, which means that developers are dependent on the security of off-tackers who are willing to pay a premium for green hydrogen. The relatively low levels of financing mean that securing the subsidy is by no means a home run by developers, and it is not permitted by developers, and it is unstatimated for developers, and it is unstatimated for developers that is not permissible.”

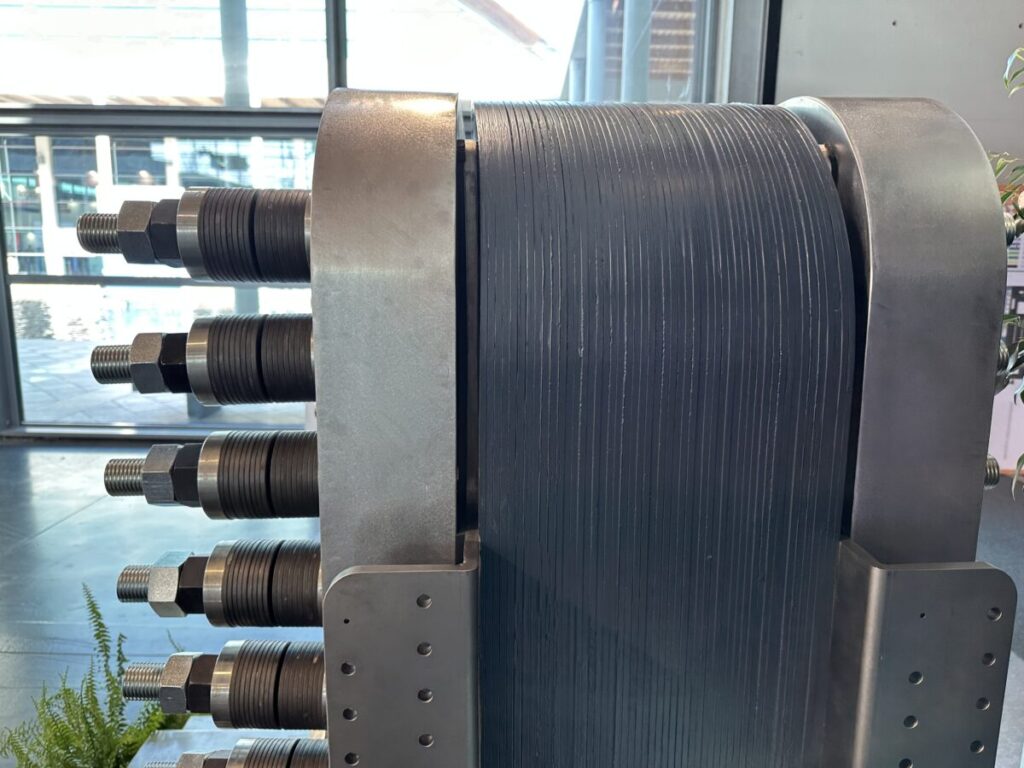

He added that although there is insufficient visibility to assess whether a specific technology has supported the lowest bids, factors such as the Electrolyzer type LCOH influenced.

“However, there is probably no specific technology a greater impact on LCOH than the energy purification strategy that remains the most important part of LCOH,” said Thomton. “Until now we have seen little evidence of economies of scale that really influence project costs. Most industry participants still lack experience with the implementation of project implementation and the immaturity of the supply chain means that we still have to see significant cost savings on larger scales.”

Tengler noted that these developers cannot receive subsidies from a source other than the auction.

“No subsidy stack is allowed for them. That is something that hydrogen lobby groups try to change in Europe. Indeed, the stimulans that these projects have won may not be enough to protect project financing,” he added. “There is a chance that some of them may not sign the financing agreements, as happened for one of the Spain-based projects selected in the first EU auction.”

Tengler added that various projects selected in the second auction were not publicly announced by their developers.

“That is also the reason why it is difficult to make every prediction about the feasibility of the project at this stage,” he said. “We are not familiar with many of these projects. If the ratio is the same as in the first auction, where only one of the seven selected projects withdraws, we can have a failure percentage of 10-20%. I currently assume that not all these projects will continue.”

Hydrogen prices

Tengler said that the auctions successfully stimulate the production and sale of hydrogen, even if they are not always designed to reach the lowest prices under current market conditions.

“If the goal is to maximize hydrogen use, the auctions are a good answer,” he claimed. “If the goal is to reduce emissions at the lowest costs, then there may be cheaper options.”

Tencler said that the energy sector must lower both the renewable energy and the electrolyzer costs in order to lower hydrogen prices.

“When it comes to hydrogen costs and prices, we have to remember that there is no real market for green hydrogen at the moment,” he explains. “The only real reference we currently have is the LCOH that a project developer must receive per kg of hydrogen that they produce during the lifetime of active.”

Bloombergnef estimates that the global LCOH between € 4/kg in China and more than € 10/kg in Japan, with Germany placing at around € 9/kg, indicating that the final prices can be considerably higher.

“Hydrogen must be transported, stored and other things must be done before you can use hydrogen,” Tengler explained.

Thomton noted that the costs of hydrogen production in Germany and the Netherlands are higher than in Iberia and the Nordics, but said it is encouraging to see projects of these markets win in the latest EU recipient.

“Moreover, the average LCOH of German bids was considerably lower than in the pilot auction, indicating that some developers make progress in the field of cost reductions,” he concluded.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.