While the cost of battery energy storage systems is falling, energy price volatility is shortening payback times for storage solutions. This shift, driven by an increase in intermittent generation from renewable energy sources and continued innovations in battery manufacturing, marks a pivotal moment for energy markets around the world.

Printed edition 24/11 from pv magazine

Energy storage installations generate returns through two primary streams: commercial revenue and contracted revenue. Contracted revenues often require reforms, market creation and government support to flourish, with key examples being capacity markets and large-scale procurement.

On the other hand, merchant revenues – which do not require an energy supplier – are organic and can evolve as more price volatility becomes present in existing market structures. In recent months, merchant revenues have become more important to the energy storage market, leading to an optimistic outlook in some key regions.

Building a profitable business case for retail storage, or any asset for that matter, depends on low capital costs (capex) and/or high revenues. These two things have changed recently, causing the growth of energy storage installations.

Seller sales increased in several key regions. The picture is somewhat cloudy because wholesale price volatility reached record levels during the 2022 energy crisis caused by Russia’s invasion of Ukraine. At the time, building a commercial business case for energy storage could have been simple, but it would have been based on shaky foundations as the drivers of energy market volatility were temporary.

Since then, volatility has fallen, but not back to previous levels and, crucially, is now rising again. This time, the volatility in wholesale prices is driven by something much more permanent: renewable energy installations, especially solar energy.

Storage arbitrage

In many regions, installed solar energy generation capacity exceeds peak electricity demand. On sunny days, more energy is generated than necessary. This has a profound effect on prices, which can routinely drop to zero or negative values. Meanwhile, solar energy generation declines in the evening, when electricity demand is often highest, and energy prices often rise.

This pattern creates the perfect environment for energy storage “arbitrage”: charging when prices are low and discharging when prices are high. This is an important time for energy storage, as installations of solar and wind energy projects are only increasing. This will increase the volatility of electricity generation and supply in the coming years and provide an even more robust business case for storage over time. Some countries have set bold targets for renewable energy sources. Spain’s latest National Climate and Energy Plan aims to reach an 81% share of renewable energy sources in electricity generation by 2030, up from around 50% in 2024.

Better technology

While this is already happening in the wholesale markets, suppliers of energy storage systems are rapidly scaling up and innovating. Recent breakthroughs in battery cell design have increased the energy density of BESS, meaning the most recently launched systems can store more energy than previous versions for the same space. This has been achieved by optimizing the interior of the battery cells with more space for electrodes, increasing capacity while keeping size and voltage unchanged.

Rising BESS capacity and falling battery raw material prices have led to a significant drop in energy storage system prices. This decline is also influenced by weaker competition for battery cells due to a slowdown in the growth of the electric vehicle market. Since 2022, we have seen prices for fully installed systems drop by approximately 40%.

Fast returns

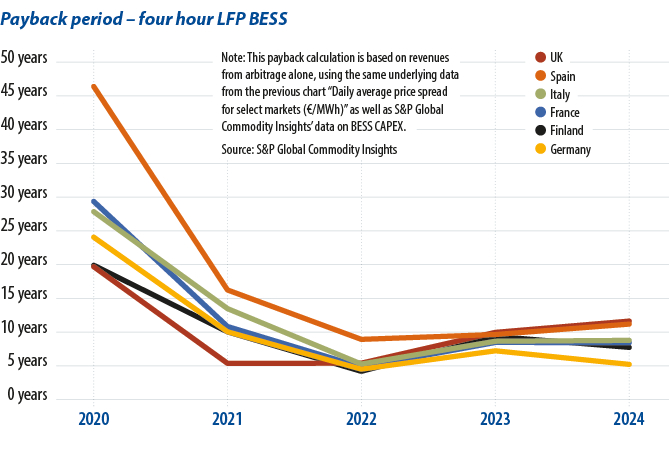

With falling prices and rising revenues, the two key elements for building a profitable business case for energy storage are moving in the right direction at the same time. Return on investment (ROI) is an important indicator, showing how long it would take for capital expenditure to be repaid under current market conditions. ROI has seen some very significant declines in recent years. Not long ago, it could take as long as 80 to 90 years to recoup a storage investment by trading in the day-ahead energy markets. Today, in many cases this figure is less than ten years. Add to that other revenue streams, such as real-time market trading, grid support services and capacity market contracts, and the business case is very strong.

Falling prices and rising revenues strengthen the business case for commercial energy storage in the future. But that may not translate directly into growth, due to the inherent risk in the trading markets. Greater development of contracted revenues plays a key role in reducing risks for investors, and wider availability would open access to capital to drive the sector forward. So despite the tailwinds behind the rise of energy storage, more needs to be done to achieve maximum growth for this crucial sector.

About the authors: George Hilton is a senior analyst focusing on batteries and energy storage with the climate and sustainability team at S&P Global Commodity Insights. He joined S&P Global in 2020 and has seven years of experience in clean energy. Hilton focuses on energy storage in Europe, the Middle East and Africa and is interested in how energy storage integrates with other industries.

Henrique Ribeiro is a principal analyst on the batteries and energy storage team at S&P Global Commodity Insights, focusing on Latin America and the Iberian Peninsula. He spent 11 years on the metals pricing team, where he helped set benchmarks for global battery metal prices, as well as steel and aluminum prices in Brazil, Chile and Mexico.

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of the author pv magazine.

This content is copyrighted and may not be reused. If you would like to collaborate with us and reuse some of our content, please contact: editors@pv-magazine.com.

Popular content