Business financing in solar energy decreased considerably in the first three months of this year due to policy rating, tariff shocks and legal uncertainties, says a report from Mercom Capital.

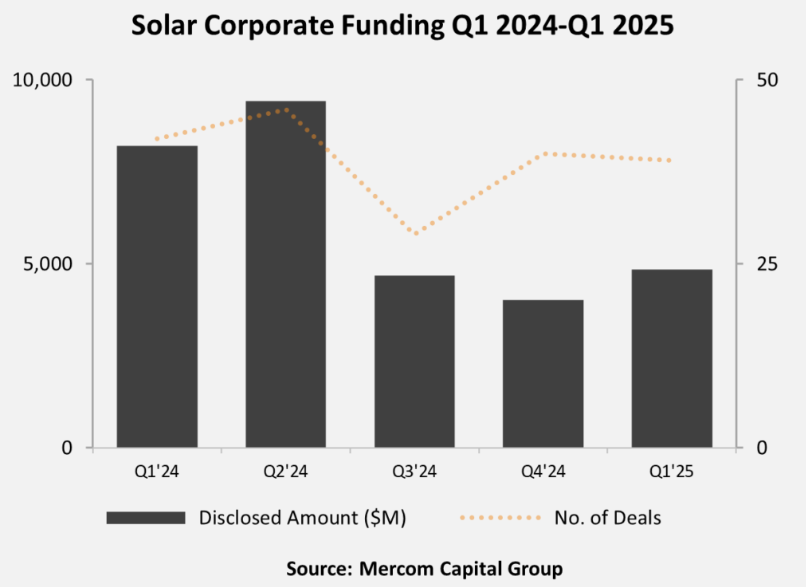

A three -month report from Mercom Capital said company Financing in Solar worldwide reached around $ 4.8 billion In Q1, 2025. This is a decrease of 41% compared to Q1, 2024 totals of $ 8.2 billion in Q1, 2024.

“The decrease in financing this quarter reflects the growing investors in response to policy revenues, tariff shocks and regulatory uncertainties that companies and investors have forced to re -assess their strategies,” said Raj Prabhu, Chief Executive Officer at MERCOM CAPITAL GROUP.

The financing, however, increased by 20% quarter-over quartaal from Q4, 2024, and “Fundamentals remain strong.”

“The case in the long term for solar energy is intact. What we need now is clarity and policy security to restore trust in the markets,” said Prabhu.

Global Venture Capital (VC) financing in Q1, 2025 reached $ 1.4 billion over 14 deals, which marked an increase compared to Q1, 2024.

The quarter was lifted by a VC increase of $ 1 billion from Origis Energy. Other important VC deals include Terabase Energy with $ 130 million; Mission of clean energy with $ 55 million; Ampin Energy Transition with $ 50 million; And Tandem PV also with $ 50 million.

At project level, approximately 13.6 GW of solar assets changed owner in Q1, 2025, of 10.8 GW in Q1, 2024 and increasing quarter-over quarter.

Project developers and independent electricity producers led acquisition activities, in which more than 8 GW of projects were secured. They were followed by investment firms and funds, which acquired 2.5 GW. Telecommunications, integrated energy traders, insurance companies and other unknown buyers represented 2.3 GW in project acquisitions, electric utilities secured 485 MW and oil and gas majors secured 245 MW.

The financing of the public market almost stopped and dropped to $ 20 million for two deals in Q1, 2025, a decrease of 99% compared to the $ 1.4 billion collected to six deals in Q1, 2024.

About $ 3.5 billion in financing was closed through debt financing in Q1, 2025, about 45% fell on an annual basis of Q1, 2024.

Mercom reported that 19 merger and acquisitions (M&A) Deals closed in the quarter, a similar level of activity to the Q1 – Last year total.

“Despite headwind in the wider financing environment, we saw an increase in M&A in the first quarter,” said Prabhu.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content