In a new weekly update for PV -MagazineOpis, a Dow Jones company, reports that the rule of pessimism in the global Polysilicon market will continue to increase, whereby the current circumstances still favor the buyers to a certain extent, so that they can maintain a degree of leverage in negotiations.

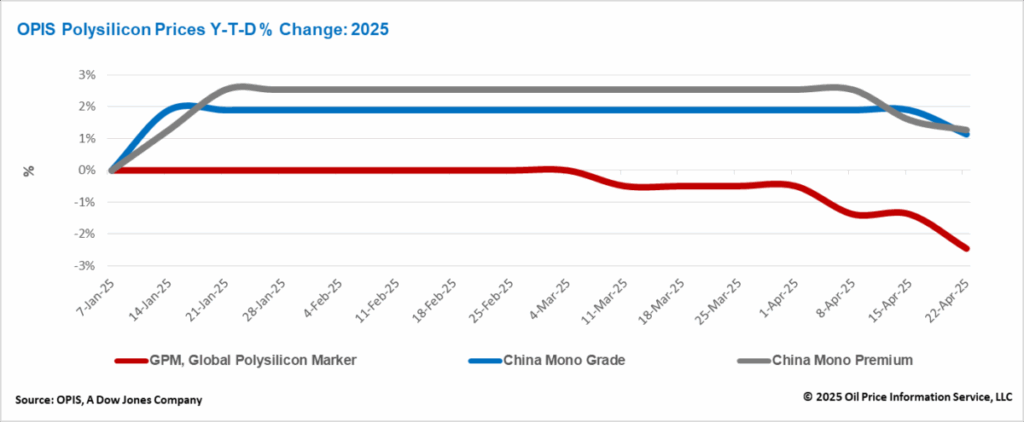

The Global Polysilicon Marker (GPM), the OPIS benchmark for Polysilicon produced outside China, was rated this week at $ 19.860/kg or $ 0.042/W, which reflects a decrease of 1.10% based on reported Buy-Sell indications.

The prevailing pessimism in the global polysilicon market continues to intensify, whereby the current circumstances still favor the buyers to a certain extent, so that they can retain a certain degree of leverage in negotiations.

Buyers-in particular that associated with long-term agreements dones are reportedly a stronger tendency to insist on price reductions, a trend that is largely attributed by insiders in the industry at the impact of rising rates on end products exported to the US exported to the vs exported have been exported to the US exported to the US that have been exported to the US

Despite this pressure on the long -term prices, small amounts of spot transactions remain outside of such agreements. According to trade sources, the lowest prices in these deals are still trending down. Market participants believe that these place purchases reflect strategic planning by certain buyers. In the light of increasing American limitations on products that contain Chinese components, these buyers proactively protect cheap materials and diversify their supply chains to reduce potential risks with stricter trade measures.

In contrast to earlier market speculation, the three-month suspension of mutual rates by the US has not considerably stimulated the production of Wafers in Southeast Asia. Consequently, the expected short -term boost in the worldwide question of Polysilicon did not come true. According to an important integrated manufacturer, the current production levels of Wafers in Southeast – Asia are sufficient to support the limited solar cell production that are currently eligible for export to the US – an output that is concentrated in just a handful of countries.

The China Mono Grade, the assessment of opis for polysilicon prices of mono-quality in the country, fell by 0.74% to CNY 33,375 ($ 4.57)/kg, equal to CNY 0.070/W. Similarly, the China Mono Premium, the price assessment of OPIS for mono-grade polysilicon used for the N-type Ingot production, fell by 0.31% week-on-week to CNY 39,875/kg, or CNY 0.084/W. This price reduction is mainly attributed to the weakening electricity demand and the continuous issue of oversupply.

The current transaction volume of Polysilicon is said to remain very low and market participants expect that large -scale polysilicon transactions may not resume until the end of May. This is mainly due to the fact that, on the basis of the current Wafers control rates, existing polysilicon inventories kept by waffel manufacturers are sufficient to retain production for more than a month.

Allegedly, large polysilicon manufacturers are planning to maintain their current low business percentages at around 40%. According to market sources, production in the Sichuan and Yunnan regions is expected to increase during the coming wet season, which brings significant discounts from electricity prize. In order to prevent a significant increase in the total output, however, manufacturers will at the same time carry out maintenance in facilities in regions that depend on thermal ability, so that the total production levels are carefully managed.

Wide pessimism around the market demand in 2025 is now putting down a downward pressure on the Chinese Polysilicon Futures market. According to data released on 21 April by the Guangzhou Futures Exchange, the future prices for Polysilicon deliveries from June 2025 to April 2026 have all fallen under CNY 40/kg. The highest settlement price, for the delivery of June 2025, was on CNY 37.89/kg, 15.39% decrease compared to the peak of January 17 of CNY 44.78/KG. This price also represents a discount of 4.98% compared to the last spot price that was assessed by Opis this week.

Opis, a Dow Jones company, offers energy prices, news, data and analysis of gasoline, diesel, aircraft fuel, LPG/NGL, coal, metals and chemicals, as well as renewable fuels and environmental products. It acquired price determination of data from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC SOLAR WEEKLY REPORT.

The views and opinions expressed in this article are the author, and do not necessarily reflect it by PV -Magazine.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.

Popular content