Indian solar manufacturers explore hybrid solutions such as BC-Topcon to bridge tunneloxide-passivated contact (Topcon) and Back-contact (BC) technologies, aimed at optimizing efficiency while the existing infrastructure is used.

India’s industry is about to have an important technological transformation. While Topcon technology dominates the domestic landscape, the global modulemarkt shifts back to contact sunmodules-the next border in efficiency.

A recent MERCOM report projects TOPcon to explain more than 58% of the annual production capacity of the solar module of India and more than 64% of the production capacity of the cell by 2027. So how do Indian manufacturers prepare for the transformative shift from Topcon to Back contact?

“Topcon technology is currently dominating the Indian market and it is expected that the leading technology for the next four to five years, given the important investments in cell production lines around the world,” said Avinash Hiranandani, vice -chairman and director of Renewsys. “Indian manufacturers, however, are already preparing for the transition to technology for return contact. Since most existing production lines can be adjusted with minimal changes, this shift is probably flexible and efficient.”

Hiranandani expects that contact modules with return contact will enter the Indian market within the next two to three years. However, BC cell technology will take three to four years.

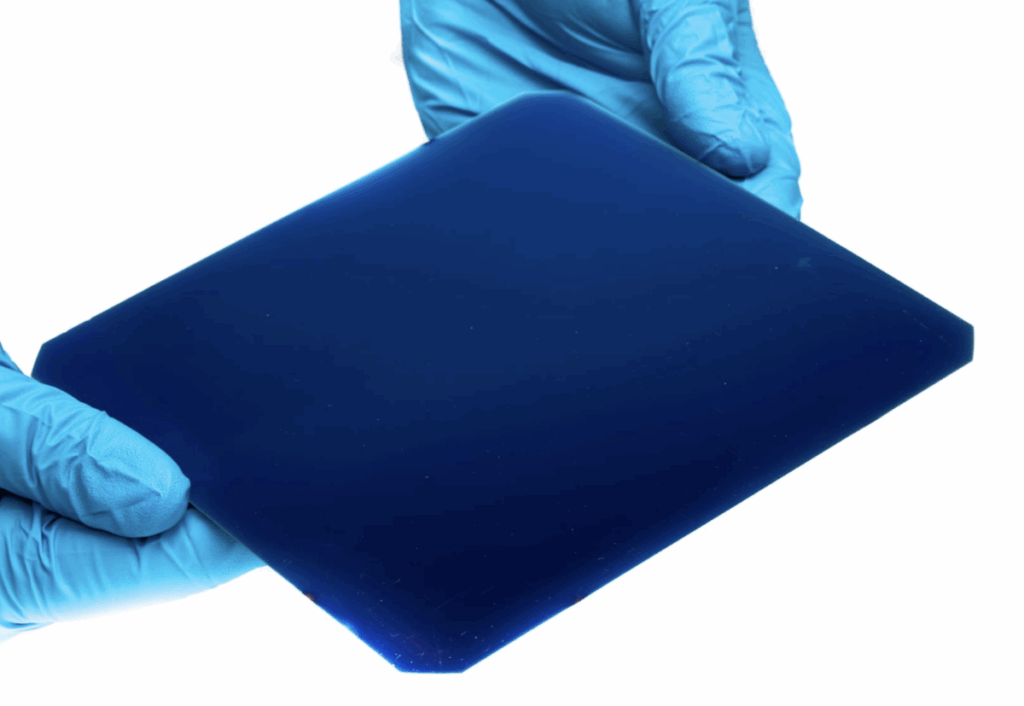

In sunscreen cells, all electrical contacts are moved to the back of the cell. This ensures greater absorption of sunlight by eliminating the shade of the front. The concept is not new.

“Back contact technology has surfaced as a very efficient driver,” said Kalpesh Kalthia, CMD at Sunray-Kosol energy. “By moving the connector components at the rear, more area for the absorption of sunlight and also modules can make a little more attractive in aesthetics.”

“However, BC is not an independent cell technology-it can be integrated with different cell types, including Topcon and N-Type HJT, which form hybrid solutions such as IBC-Topcon or HJT-IBC.”

Sunray-Kosol has developed a 620 WP Topcon module with 24% efficiency and size dimensions of a regular 550 WP module, housed in a regular frame-the balance between system (forest) costs.

Like most other manufacturers in India, Sunray-Kosol has built production lines that are cellagnostic to make a smoother transition to BC or other future technologies possible.

“For the American acceptance of technologies such as Back-Contact has been announced in our industrial blue print preparation that is included in our proposed industrial expansion in India and the world markets,” said Kalthia.

Kalthia expects the arrival of contact modules in India in India in early 2026.

“The most important factor is that BC modules must be tested in 3 × IEC conditions. The back contact technology is also offered by only a few companies that will limit their availability. Since 3 × IEC tests last 7-8 months, the massive commercialization in China will see and will be offered in Selection.

Solex Energy chairman Chetan Shah expects Topcon to continue to lead the market in the coming years. “With a relatively smooth transition route from PERC, TOPcon offers significant profit in efficiency and cost percentage, which is why we expect it to lead the market in the coming years,” Shah said.

At the same time, Solex is actively preparing for the future by investing in R&D, exploring hybrid approaches such as TopconBC and following the worldwide progress in BC technology.

“Although the shift to BC may not happen overnight, we position ourselves strategically to take it at the right time – when the economy, infrastructure and ecosystem are fully supportive,” Shah said.

Kumar Shivam, area sales manager, Axitec Energy India, says that modules of the next generation such as interdicted back contact (IBC), heterojunction with intrinsic thin-layer (HJT-IBC) and emerging hybrid configurations in the future of solar energy energy in India. By going the current route map, he expects the commercial production of BC -Zonne modules in India to start by 2026, with Reliance Industries who are in charge.

“Mass acceptance and noticeable market penetration are likely to take place between 2027 and 2028, when more manufacturers compete and scale benefits start to make technology more cost more competitive,” said Shivam. “By 2029 BC modules can be 20% or more of the Indian market, which indicates a potential turning point for this very efficient segment.”

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.