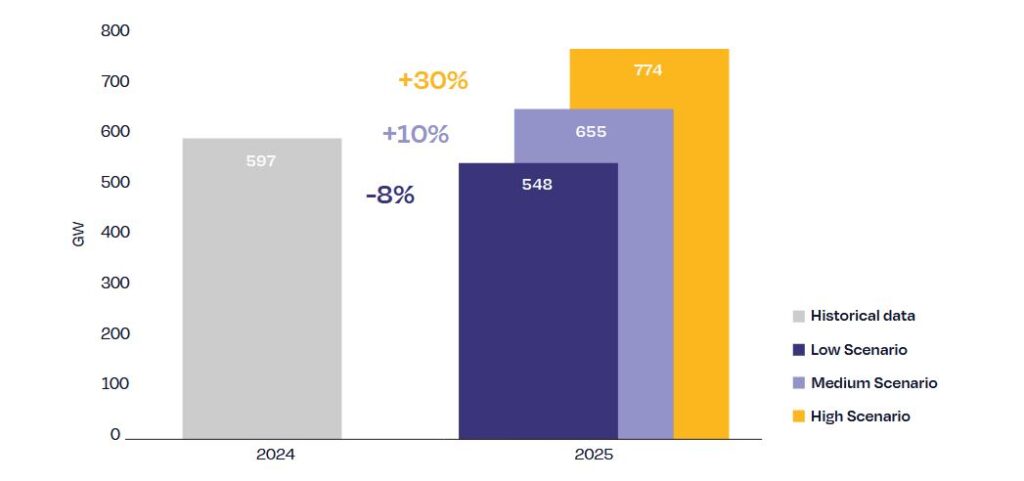

The European PV trading organ said that new PV installations reached 597 GW in 2024, with a global cumulative PV capacity of 2.2 GW.

This year the world can add new PV capacity to 655 GW, according to the Worldwide market front views for solar energy 2025-2029 Report published by the European PV Association Solarpower Europe.

If confirmed, this result would represent a growth of 10% compared to 2024, when around 597 GW of new PV systems were used worldwide, with a global cumulative PV capacity that reached 2.2 GW at the end of December.

The association presented three different scenarios for 2025: the high scenario with a maximum of 774 GW of annual additions; The Mid scenario that has an extension of 655 GW, the authors of the report said that is the most likely development process; And the low scenario with only 548 GW new PV power is expected.

“This scenario underlines the risks of escalating trade conflicts, which can increase the PV system costs, delay project piping and investments in particular can scare up price-sensitive markets,” notes the report, referring to the low scenario. “In the EU-27, the solar market could quickly move from stagnation to contraction in 2025, mainly if framework conditions are not implemented quickly and correctly in the Member States.”

The high scenario, on the other hand, is expected to occur with persistent low module prices, high installation rates and a new push from the Chinese government to increase PV implementations, Solarpower Europe experts said.

It is predicted that this year China will take into account around 53%of the new global installations, followed by the Asia-Pacific (APAC) without China (16%), America (14%), Europe (13%) and the Middle East and Africa (MEA) region (4%).

Solarpower Europe also predicted that between 2026 and 2028 the world can install about 2.27 TW of new PV power, which reduces its earlier prospects of 2.34 TW. “Our updated prediction still expects a solid annual growth in the reach of 10-14%, broadly in line with last year’s estimate of 12-13%,” the report says. “2026, however, stands out as a clear exception, whereby the growth is expected to delay only 1%.”

It is predicted that the performance of 2026 will be influenced by the transition from feed-in rates to feed-in premium rates in China, which must be felt from the second half of 2025, where project developers postpone investment decisions and revise their business models.

“In general, our medium scenario projects the global PV market 665 GW in 2026, against 655 GW in 2025. We expect that the annual additions will reach 755 GW in 2027, 847 GW in 2028 and 930 GW in 2029,” the report says.

This content is protected by copyright and may not be reused. If you want to work with us and reuse part of our content, please contact: editors@pv-magazine.com.