Quality in the voluntary carbon market (VCM) is showing promising signs of improved integrity, according to a new analysis from carbon credit rating platform Calyx Global. The report combines market trend data with Calyx Global’s assessments of more than 500 projects to provide insight into ongoing efforts to improve the integrity of the carbon market.

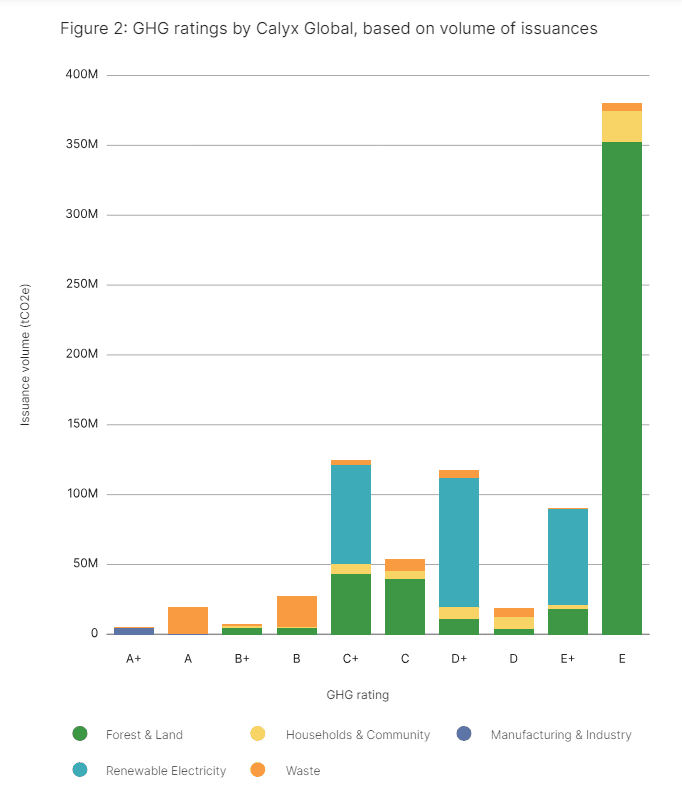

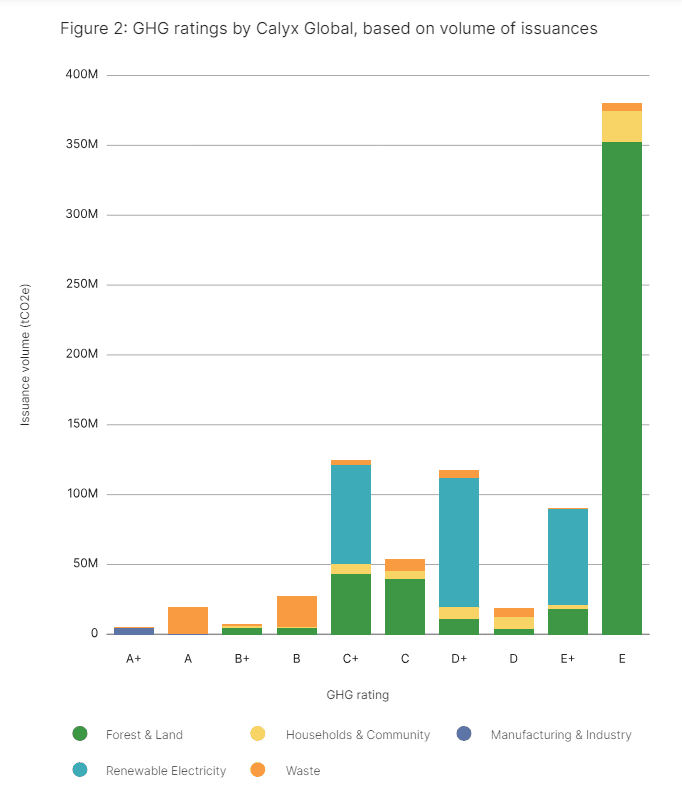

Finding higher-rated carbon credits in the VCM remains a challenge due to the dominance of mega-projects, such as REDD (Reducing Emissions from Deforestation and Forest Degradation) and large-scale grid-connected renewable energy projects, which typically do not achieve higher ratings (A and B).

Calyx Global co-founder Donna Lee emphasizes the need for higher quality carbon credits to restore confidence in the market.

“We wanted to start monitoring quality, recognizing that the voluntary carbon market is starting to mature. The faster we improve the quality of carbon credits and restore trust, the more effectively companies can tackle climate change.”

The report, “The state of quality in the voluntary carbon market”identifies the key trends and below are the key findings.

Decrease in the number of low-quality CO2 credits issued

Since 2021, media attention to the voluntary carbon market has intensified, coinciding with an increase in carbon credit issuance. Both market volume and media criticism peaked in 2023. However, there has been a notable shift in the quality of credit issuance, especially from early 2024 onwards.

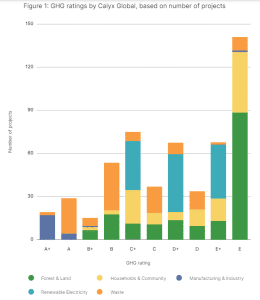

Quality in the VCM varies widely, with both poor and high quality credits analyzed in each sector Chalice Global. To date, projects in the manufacturing and industrial sectors have the highest greenhouse gas integrity.

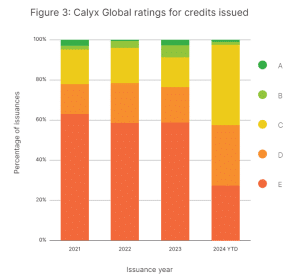

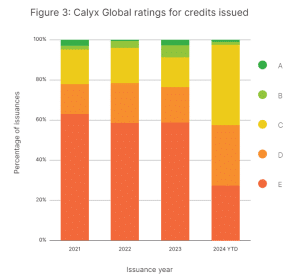

According to the analysis, which assessed more than half of all credits issued over the past five years, only about 20% of these credits fall into the top half of their rating scale (C+ and above).

It is striking that less than 10% of the assessed loans received a B rating or higher. This underlines the difficulty in obtaining high-integrity carbon credits in the current market landscape.

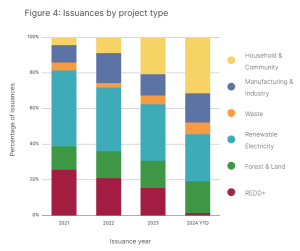

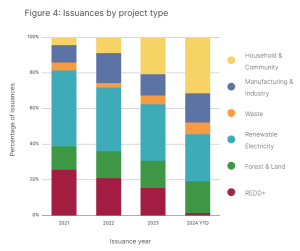

The issuance of low-rated credits (E-rating) has declined significantly, by almost 50%. This decrease is mainly due to a reduction in credits issued by REDD+ projects. These credits have historically tended toward lower ratings.

The decline in REDD+ credits has been partially offset by an increase in issuance of household and community projects, such as cooking stove credits. These projects typically have more credits in the “C” rating range.

Despite the general improvement in credit quality, highly rated credits (A and B ratings) remain rare. This rarity is due to the smaller number of such projects currently actively issuing credits on the market. Additionally, these higher-rated projects tend to be smaller in scale compared to mega-projects such as REDD and large-scale renewable energy projects.

Slow adoption of quality updates

Despite recent shifts towards higher quality in the VCM, a clear and consistent trend has yet to emerge.

More than 75% of new entries in major registries – American Carbon Registry (ACR), Climate Action Reserve (CAR), Gold Standard and Verified Carbon Standard (VCS) – come from the Forest & Land and Household & Community sectors. These sectors show mixed results in Calyx Global’s rating system.

The forest and land sector is dominated by improved forest management (IFM) and afforestation/reforestation (AR) projects, which are undergoing methodological changes aimed at increasing their effectiveness and integrity.

In the Household and Community sector, cookstove projects make up the majority of new listings. And efforts are underway to refine cookstove methodologies to improve their quality and impact.

It may take some time for low-quality credits to completely disappear from the system. Some low-quality credits are still locked into forward contracts, delaying the full impact of improved quality standards. While improvements have been made to the rules and requirements for generating carbon credits, these updates still need to be fully integrated into the active market.

A trade-off: greenhouse gas integrity versus SDG impact

While buyers are attracted to benefits “beyond carbon,” such as social and environmental benefits, the main driver of market trends is the search for higher greenhouse gas (GHG) integrity.

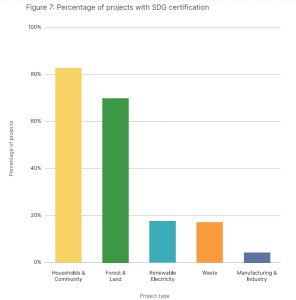

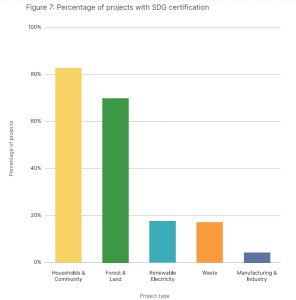

About 54% of greenhouse gas integrity projects assessed have had contributions to the Sustainable Development Goals (SDG) verified by a third party. This trend is especially prevalent among nature-based projects, which often pursue additional SDG certification through programs such as Verra’s Climate, Community, and Biodiversity (CCB) Standards and the Sustainable Development Verified Impact Standard (SD VISta), resulting in verified SDG -contributions.

In contrast, waste and renewable energy projects often do not seek additional SDG certification. Or they are registered under programs that do not require verification of SDG claims.

Some argue that the ideal carbon credit should have both high GHG integrity and significant SDG impact. However, according to Calyx Global’s findings, such credits are currently difficult to find. There appears to be a trade-off in the current market between the integrity of greenhouse gases and the impact of the SDGs.

This trade-off is partly because many projects that deliver the highest SDG impact, such as REDD+ and Cookstove projects, have problems with overcrediting.

Household projects often have verified SDG contributions, largely due to the Gold Standard’s requirement to report, monitor and verify at least three SDGs per project. Verra has now introduced a similar requirement.

Calyx Global concludes that the VCM continues to evolve and is moving towards version 2.0. This analysis is crucial to build confidence in carbon credits and enable them to contribute effectively to climate change mitigation.